Most full-time employees work about 2,080 hours per year—based on a 40-hour workweek for 52 weeks. But in reality, very few people actually hit that number. So how many work hours in a year do most people actually log?

Holidays, paid time off, sick days, and schedule changes can significantly lower your total hours worked. And if you work overtime, part-time, or non-traditional shifts, your number could be much higher or lower.

Why does it matter? Because your total work hours affect how you budget, what you earn, how you schedule time off, and even how you set project timelines. Whether you’re a business owner, manager, or employee, understanding your real work hours gives you a clearer picture of your time and productivity.

This guide breaks it all down:

- How to calculate your total work hours (with and without time off)

- Work hour estimates for weekly schedules from 20 to 80 hours

- Real-world examples by job type and industry

- Why these numbers matter for pay, productivity, and planning

- Legal considerations and non-traditional shifts

- Helpful calculators and tools for tracking your time

TIMECLICK TIP

Don’t assume you’re working 2,080 hours a year.

The OECD reports the average U.S. worker clocks closer to 1,811 hours per year. That’s 269 fewer than the 40-hour/week estimate. Always calculate based on your real schedule, not the default.

Table of Contents

- Quick Answer: How Many Working Hours in a Year?

- GUIDE SUMMARY

- How to Calculate Hours Worked Per Year

- Step 1: Weekly Working Hours × 52

- Step 2: Subtract Time Off

- Real-World Work Hour Examples

- Annual Work Hours by Job Type and Industry

- Why Knowing Your Annual Work Hours Matters

- Budgeting and Income Planning

- Planning PTO Strategically

- Work-Life Balance

- Payroll and Compliance Accuracy

- Smarter Decision-Making

- Legal Limits: What Employers Should Know

- Federal vs. State Labor Law Comparison

- PTO Laws by State (Quick Summary)

- Frequently Asked Questions About Annual Work Hours

- Track Your Hours Automatically with TimeClick

- What You Can Do with TimeClick:

- Final Thoughts

Quick Answer: How Many Working Hours in a Year?

The standard U.S. full-time schedule assumes 40 hours per week for 52 weeks—that’s 2,080 work hours per year.

This assumes no vacation, sick leave, or holidays—which almost no one skips entirely. So while 2,080 is a helpful baseline, your real total is usually lower.

Note: While 2,080 hours is the U.S. full-time standard (40 hours/week × 52 weeks), this number varies globally. For example, workers in Germany average around 1,349 hours/year, while those in Mexico average over 2,200. If you're outside the U.S., your baseline may be quite different depending on labor laws and cultural norms [Source].

GUIDE SUMMARY

How Many Work Hours in a Year?

- Standard full-time: 40 hours/week × 52 weeks = 2,080 hours/year

- With time off: Subtract holidays, vacation, sick days, and unpaid leave

- Real totals vary: Most people end up between 1,800–1,950 hours/year

- Why it matters: Accurate hours help you plan pay, projects, and PTO

- Work more or less? Use the time card calculator to adjust based on your weekly hours

How to Calculate Hours Worked Per Year

Whether you’re full-time or part-time, you can calculate how many work hours in a year you’re actually working using this formula:

(Weekly hours × 52) − (Days off × Daily hours)

Example: You work 40 hours/week, 8 hours/day, and take 10 vacation days + 11 paid holidays.

Calculation: (40 × 52) − ((10 + 11) × 8) = 2,080 − 168 = 1,912 hours

TIMECLICK TIP

Account for unpaid time off too.

Not all days off are paid. If you take unpaid leave or work fewer hours during slow months, those hours need to be subtracted as well. For the most accurate number, track your actual worked days—not just what’s on paper.

This formula gives you a clear starting point—but to get a realistic number, you’ll want to break it into two simple steps: first, find your total scheduled hours; then subtract any time you’re not working.

Step 1: Weekly Working Hours × 52

Start with how many hours you typically work each week. Multiply by 52 weeks to get your total hours before any time off:

| Weekly Work Hours | Estimated Yearly Hours |

|---|---|

| 20-hour workweek | 1,040 work hours/year |

| 25-hour workweek | 1,300 work hours/year |

| 30-hour workweek | 1,560 work hours/year |

| 35-hour workweek | 1,820 work hours/year |

| 37.5-hour workweek | 1,950 work hours/year |

| 40-hour workweek | 2,080 work hours/year |

| 45-hour workweek | 2,340 work hours/year |

| 50-hour workweek | 2,600 work hours/year |

| 55-hour workweek | 2,860 work hours/year |

| 60-hour workweek | 3,120 work hours/year |

| 65-hour workweek | 3,380 work hours/year |

| 70-hour workweek | 3,640 work hours/year |

| 75-hour workweek | 3,900 work hours/year |

| 80-hour workweek | 4,160 work hours/year |

TIMECLICK TIP

Tip: Use your payroll reports as a baseline

Want to avoid guessing? Pull last year’s payroll or timesheets. They’ll show exactly how many hours you logged—then adjust for expected changes this year.

This gives you your gross work hours. But remember—vacation, holidays, and sick days all subtract from that total. Let’s adjust for that next.

Step 2: Subtract Time Off

Now subtract the hours you won’t be working due to paid time off, holidays, or sick leave.

Example: You work 8-hour days and take:

- 10 vacation days

- 5 sick days

- 11 holidays

That’s 26 total days off × 8 hours/day = 208 hours off

Start with 2,080 hours (40 hours/week × 52 weeks):

2,080 − 208 = 1,872 actual work hours for the year

Real-World Work Hour Examples

- Construction crew (45 work hrs/week, 15 days off):

(45×52) − (15×9) = 2,340 − 135 = 2,205 annual work hours - Retail associate (30 work hrs/week, no time off):

30×52 = 1,560 annual work hours - Marketing agency employee (37.5 work hrs/week, 20 days off):

1,950 − (20×7.5) = 1,800 annual work hours - Project manager (salaried, 40 work hrs/week, 15 days off):

(40×52) − (15×8) = 2,080 − 120 = 1,960 annual work hours

TIMECLICK TIP

Expect around 11–14 vacation days if you're just starting out.

According to the U.S. Bureau of Labor Statistics, that’s the average for full-time employees with one year of service. Plan your PTO around that number—or more if you've been with your employer longer.

As you can see, your job type, schedule, and PTO policy all shape your actual hours. Let’s look at how this works across industries.

Annual Work Hours by Job Type and Industry

Different industries come with different schedules, expectations, and hour demands. Whether you're salaried, hourly, part-time, or shift-based, your actual hours can vary widely from the standard 2,080.

| Industry | Typical Weekly Hours | Estimated Annual Hours | Notes |

|---|---|---|---|

| Retail | 30–35 | 1,560–1,820 | Often part-time; shifts vary by season and staffing needs. |

| Construction | 40+ | 2,080+ | Longer hours during peak seasons; may include overtime. |

| Healthcare | 36–40 | 1,872–2,080 | Common 12-hour shifts, nights, and weekends. |

| Tech / IT | 40–50+ | 2,080–2,600+ | Project deadlines and support needs often extend hours. |

| Hospitality | 30–40 | 1,560–2,080 | Evenings, weekends, and holidays are typical. |

| Education | Varies | ~1,300–1,600 | Teachers often work fewer days but longer hours during the year. |

These numbers are averages. Your exact hours will depend on your specific job, employer, and policies around overtime, breaks, and PTO.

TIMECLICK TIP

Talk to your HR team or supervisor.

If you’re unsure what counts as paid time, PTO, or holiday leave in your role, ask. Company policies vary—and even hourly employees sometimes get benefits you didn’t know were available.

Curious how many work hours in a year your role adds up to? Use the free Time Card Calculator to run the math based on your actual schedule.

Once you know your numbers, it’s time to put them to use. Understanding your real work hours isn’t just helpful—it directly impacts your time, money, and planning.

Simplify Time Tracking with TimeClick!

Download our free trial—simple, secure, offline tracking, no fluff.

Why Knowing Your Annual Work Hours Matters

Knowing how many hours you actually work—and how many work hours are in a year for your role—isn’t just trivia—it’s a powerful planning tool that impacts your finances, your health, and your time. Here’s why understanding your annual work hours is essential, whether you’re an employee, contractor, or business owner:

Budgeting and Income Planning

Let’s say you earn $25/hour. If you assume you’re working 2,080 hours a year, your projected income is $52,000. But if you actually take three weeks off, your total hours might drop to 1,928—reducing your earnings to $48,200. That’s a big difference.

Accurate work hour totals help you:

- Forecast your take-home pay more precisely

- Plan for savings, investments, and expenses

- Set realistic income goals for the year

Planning PTO Strategically

Time off isn’t free if you’re hourly, freelance, or part-time. Every day off affects your bottom line. Knowing your yearly hours helps you schedule vacations and personal days without accidentally cutting too far into your income.

It also helps businesses ensure they have proper coverage during busy periods—like holidays or product launches—by understanding when and how often employees are likely to take time off.

Work-Life Balance

If you don’t know how many hours you’re logging, it’s easy to fall into the trap of overworking. Tracking annual hours gives you visibility into your workload so you can:

- Spot burnout risks before they become problems

- Adjust your schedule to avoid working 50+ hour weeks every quarter

- Set boundaries to protect your mental health and personal time

TIMECLICK TIP

According to the Headspace 2024 Workforce State of Mind Report, 77% of employees say work-related stress has negatively affected their mental health. Tracking your hours helps you spot overwork early and protect your well-being before burnout sets in.

When you manage your time like a budget, you avoid overspending energy and underinvesting in rest.

TIMECLICK TIP

Compare your tracked hours to how you feel.

If you feel constantly overworked but your actual tracked hours are within a healthy range, the issue may be workload intensity—not time. Use hours as a check-in, not just a total.

Payroll and Compliance Accuracy

For employers, tracking work hours is crucial for payroll accuracy and legal compliance—especially when dealing with hourly staff, overtime pay, and benefits eligibility.

Getting the hours right ensures:

- Employees are paid accurately for every hour worked

- Overtime is tracked and paid correctly

- You meet labor law requirements around breaks, holidays, and sick leave

Even small miscalculations—like missing 10 minutes a day—can add up to major payroll discrepancies over the year.

Case in point: In 2022, the U.S. Department of Labor found wage and hour violations in 80% of garment industry investigations in Southern California. Many of these issues were tied to inaccurate timekeeping or employee misclassification—problems that could have been avoided with proper tracking systems in place.

Smarter Decision-Making

Understanding how much time you actually have to work lets you plan more intelligently. Whether you’re scheduling a team project, budgeting client hours, or setting personal goals, you’ll make better decisions when you base them on real data—not guesses.

Bottom line: When you know your true work hours, you’re in control of your time, your money, and your energy.

Understanding your hours is useful—but understanding the legal boundaries around those hours is critical. Whether you're an employer building compliant policies or an employee safeguarding your rights, staying informed about labor laws helps you avoid costly mistakes.

Legal Limits: What Employers Should Know

Work hour laws in the U.S. are primarily governed by the Fair Labor Standards Act (FLSA), but many additional rules are set at the state level. Here's what every employer (and employee) should be aware of:

- Full-time vs. Part-time Definitions: The FLSA doesn’t legally define "full-time," but most employers use 40 hours/week as the standard. Some benefits, like healthcare under the ACA, may apply to employees working 30+ hours/week, so it’s important to align your internal policies with federal benchmarks.

- No Federal Requirement for Paid Time Off: Contrary to popular belief, the FLSA does not require employers to offer paid vacation, holidays, or sick leave. These are entirely up to employer discretion—unless you're in a state or city with its own PTO laws (like California, New York, or Washington).

- Overtime Rules: Non-exempt employees are entitled to overtime pay—1.5x their regular rate—after working more than 40 hours in a single workweek. Some roles may be "exempt" (e.g., salaried executives), but misclassifying employees can lead to serious penalties.

- Meal and Rest Breaks: The FLSA doesn’t require meal or rest breaks, but many states do. For example, California mandates a 30-minute meal break for shifts over 5 hours and paid 10-minute rest breaks for every 4 hours worked. Know your local rules—they matter.

- State-Specific Laws: Some states go further with worker protections. Massachusetts, for example, limits the number of consecutive hours nurses can be scheduled. Illinois requires PTO payout upon termination. Always check your state’s Department of Labor for specifics.

- Timekeeping Requirements: Employers are required to keep accurate records of time worked and wages paid. Inaccurate or missing records can lead to compliance issues, especially in wage/hour audits or employee disputes. Time tracking software like TimeClick can help automate this and maintain legally sound logs.

TIMECLICK TIP

Misclassifying employees can be costly.

If you’re a business owner, improperly categorizing an hourly employee as exempt could lead to thousands in back wages and fines. When in doubt, check with a labor law specialist.

While federal labor laws provide a nationwide baseline, many key rules—like paid leave and breaks—are determined at the state level. Understanding how these regulations compare can help you avoid compliance mistakes and ensure your policies are up to date.

Federal vs. State Labor Law Comparison

Here’s a quick look at how federal labor laws stack up against specific state requirements. Use this as a reference point, but always check your state’s current rules for the most accurate information.

| Category | Federal Law (FLSA) | State Example |

|---|---|---|

| Minimum Wage | $7.25/hour (as of 2025) | California: $16/hour |

| Paid Sick Leave | Not required | New York: Up to 56 hours/year |

| Meal Breaks | Not required | California: 30 minutes after 5 hours |

| Rest Breaks | Not required | Washington: 10 minutes for every 4 hours |

| Overtime | 1.5× after 40 hours/week | Same, but some states monitor daily limits too |

Bottom line: Even if you’re using a standard 40-hour workweek, compliance isn’t automatic. Make sure your time tracking, classification, and PTO policies are aligned with both federal and state laws. It protects your business—and your team.

Paid time off (PTO) is one of the biggest differences between states. While the federal government doesn’t mandate it, many states do. Let’s take a closer look at how PTO laws vary depending on where you work.

PTO Laws by State (Quick Summary)

This table summarizes PTO-related laws in several major states, including whether paid sick leave is required, if unused time must carry over, and whether PTO needs to be paid out when employment ends.

| State | Paid Sick Leave Required | Carryover Required | Payout on Termination |

|---|---|---|---|

| California | Yes | Yes (unused PTO must carry over) | Yes (PTO treated as wages) |

| New York | Yes (56 hours/year in most cases) | Yes (unless policy states otherwise) | No (unless policy promises it) |

| Texas | No | No requirement | Only if employer policy says so |

| Illinois | Yes (starting 2024) | Yes (if accrued) | Yes (if accrued and earned) |

| Florida | No | No requirement | No (employer discretion) |

| Washington | Yes (1 hour per 40 worked) | Yes | No (unless contract requires) |

Still have questions about how annual work hours or time off policies apply to you? These common FAQs break down what you need to know, whether you're hourly, salaried, or somewhere in between.

Frequently Asked Questions About Annual Work Hours

How many work hours are in a year without time off?

If you work 40 hours per week with no vacation, sick days, or holidays, you’ll work a total of 2,080 hours per year (40 hours × 52 weeks). This is the standard full-time baseline.

How many work hours are in a year with holidays?

If you get 11 paid holidays and work 8 hours per day, that’s 88 hours off. Subtract that from 2,080 and you’re left with 1,992 hours for the year.

What about leap years?

A leap year adds an extra day—February 29. If that day falls on a weekday, it adds one more workday. So instead of 260 weekdays, you’d have 261. That’s 2,088 work hours for a full-time schedule (261 × 8 hours/day).

How do I calculate how many work hours in a year I actually work?

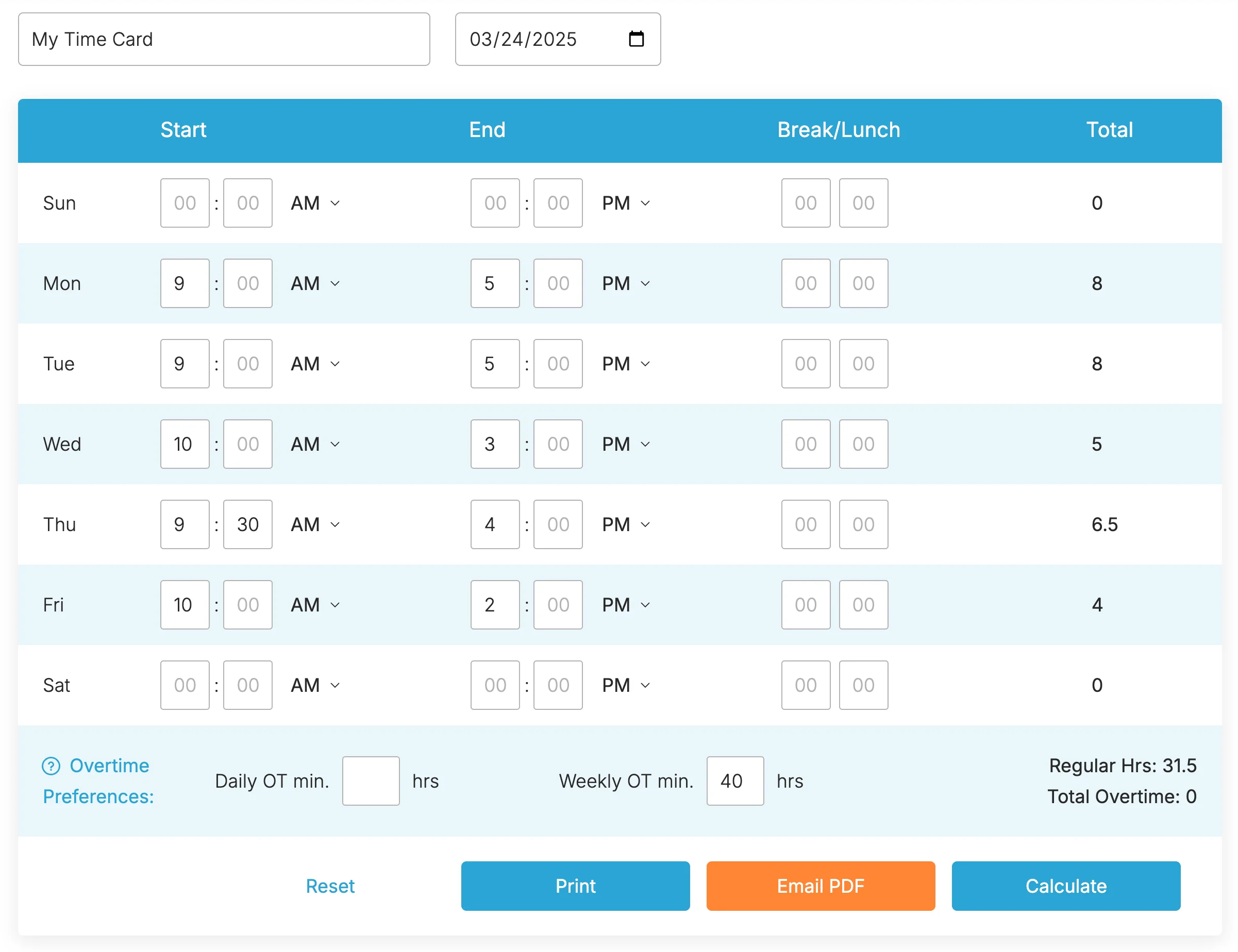

Use the formula: (Weekly Hours × 52 Weeks) – (Days Off × Daily Hours). This gives you a clear total based on your personal schedule. You can also use tools like the TimeClick Time Card Calculator to run the math automatically.

How do I calculate hours for a 4-day workweek?

If you work four 8-hour days each week, that’s 32 hours/week. Multiply by 52 weeks to get 1,664 work hours per year.

How many hours do salaried employees work?

Most salaried employees are expected to work around 40 hours per week, which totals 2,080 hours per year. However, some roles may involve unpaid overtime or flexible schedules, so actual hours can vary.

What’s Considered Full-Time & How Many Working Hours Is That Per Year?

The IRS defines full-time as 30+ hours per week for benefits eligibility, but most employers use 40 hours/week as the standard. Only 40 hours/week across 52 weeks results in the full 2,080-hour year.

Do I need to track hours if I’m salaried?

It depends on your company and your role. Even salaried employees can benefit from tracking hours for project management, work-life balance, or transparency in hybrid/flexible work environments.

How do holidays work if I’m salaried?

If you're a salaried (exempt) employee, whether you get paid for holidays depends on your employer's policy—there’s no federal requirement for paid holidays. Most full-time salaried workers do receive holiday pay as part of their benefits package, but it's not guaranteed by law.

Can PTO be carried over from year to year?

It depends on your employer’s policy and your state’s labor laws. Some companies have “use-it-or-lose-it” policies, while others allow carryover up to a cap. In California, for example, use-it-or-lose-it policies are not allowed—unused PTO must roll over or be paid out. Always check your employee handbook or local regulations.

How do I make sure my calculations are accurate?

Use a tool like the TimeClick's free Time Card Calculator to avoid errors. For ongoing accuracy and reporting, TimeClick's full software tracks time, PTO, and breaks automatically.

Track Your Hours Automatically with TimeClick

Manually calculating your annual work hours is helpful—but it’s not something you want to do every week. That’s where TimeClick comes in.

Whether you manage a team or just want a reliable way to track your own time, TimeClick makes it simple. It’s designed for small businesses, in-office teams, and anyone who values accuracy without the hassle of cloud-based complexity.

What You Can Do with TimeClick:

- Clock in/out with one click: Track start and end times without spreadsheets or paper.

- Auto-deduct unpaid time: Set rules for breaks and lunches so you never have to manually adjust totals.

- Enforce buffer rules: Prevent early punches and track punctuality with grace periods.

- Track PTO and holidays: Handle time-off requests and see who’s available at a glance. Watch the full webinar below:

- Export payroll-ready reports: Send clean timesheets straight to QuickBooks or other payroll software.

- Run offline: No cloud, no recurring fees. TimeClick stores everything locally on your secure system.

With TimeClick, you don’t have to guess or recalculate—your team’s hours, PTO, and schedules stay organized and accurate in real time.

Start your free 14-day trial today and see how much time you save when tracking is built right in.

Final Thoughts

Knowing how many hours you work in a year isn’t just a nice-to-know—it’s a critical number for planning your time, income, and team operations. While 2,080 hours is a standard estimate, your real number depends on your schedule, paid time off, and how consistently you track time.

TIMECLICK TIP

Recalculate at least twice a year.

Your hours change. Schedules shift. Vacations happen. Set a reminder to recalculate mid-year and at year-end to stay aligned with your goals and budget.

If you’re managing payroll, estimating labor costs, or trying to improve work-life balance, accurate hour tracking makes everything easier. It helps you spot trends, avoid burnout, and make smarter decisions—whether you're a small business owner, manager, or hourly employee.

And if you’re tired of guessing? TimeClick takes the work out of work hour tracking. It’s fast, reliable, and built for teams that want accuracy without added complexity.

Start your free 14-day trial and get a real answer to how many work hours in a year you’re actually putting in.

Start your FREE TimeClick Trial Today.