Hiring the right employee isn’t cheap—and it’s only getting more expensive. In 2025, businesses are dealing with a perfect storm of rising labor costs, talent shortages, inflation, and increased reliance on recruitment tech. Every new hire brings not just a salary, but a long list of hidden expenses.

According to the Society for Human Resource Management (SHRM), the average cost-per-hire is now around $4,700—but for specialized roles, executive positions, or companies in high-cost regions, that number can exceed $20,000 per employee.

And that’s just the surface. Between recruiter fees, HR software, background checks, training, and productivity loss during onboarding, the real cost of hiring can be hard to pin down—especially if you’re not tracking it.

This guide breaks it all down. We’ll cover:

- What’s actually included in the cost of hiring

- Real-world cost breakdowns by role and company size

- How to calculate your cost per hire (with examples)

- Ways to reduce hiring costs without sacrificing candidate quality

- Optional calculator and compliance considerations for U.S. hiring

Whether you’re an HR lead at a growing company or a founder scaling your team, this is your go-to resource for hiring smarter in 2025—and spending your recruitment budget where it matters most.

Table of Contents

- The Cost of Hiring: What’s Included?

- Hard Costs

- Soft Costs

- Real-World Hiring Cost Range

- Cost Per Hire Formula (With Example)

- The Basic Formula

- What Counts as Internal vs. External?

- Small Business Example

- Enterprise Example

- Cost Breakdown by Role

- External vs Internal Hiring Costs

- Internal Hiring Costs

- External Hiring Costs

- When Does Outsourcing Make Sense?

- Other Hidden Costs You Might Be Missing

- 1. Turnover and Replacement Costs

- 2. Culture Misalignment

- 3. Productivity Lag

- 4. Overhead and Equipment

- 5. Compliance and Legal Risk

- How to Reduce Hiring Costs Without Cutting Corners

- 1. Use Skills-Based Hiring

- 2. Write Crystal-Clear Job Descriptions

- 3. Streamline Your Interview Process

- 4. Automate Onboarding

- 5. Build a Talent Pipeline

- 6. Track Cost Per Hire (and Optimize)

- Free Hiring Cost Calculator

- What You’ll Need

- U.S. Hiring Cost Compliance Factors

- 1. Payroll Taxes (FICA)

- 2. Federal and State Unemployment Taxes (FUTA/SUTA)

- 3. Workers’ Compensation Insurance

- 4. Overtime & Wage Rules

- 5. Required Leave Laws (FMLA, State Mandates)

- 6. Retirement Plan Requirements

- 7. Mandatory Postings & Recordkeeping

- What Is a Fully Loaded Cost?

- Final Thoughts: Spend Smarter, Hire Better

The Cost of Hiring: What’s Included?

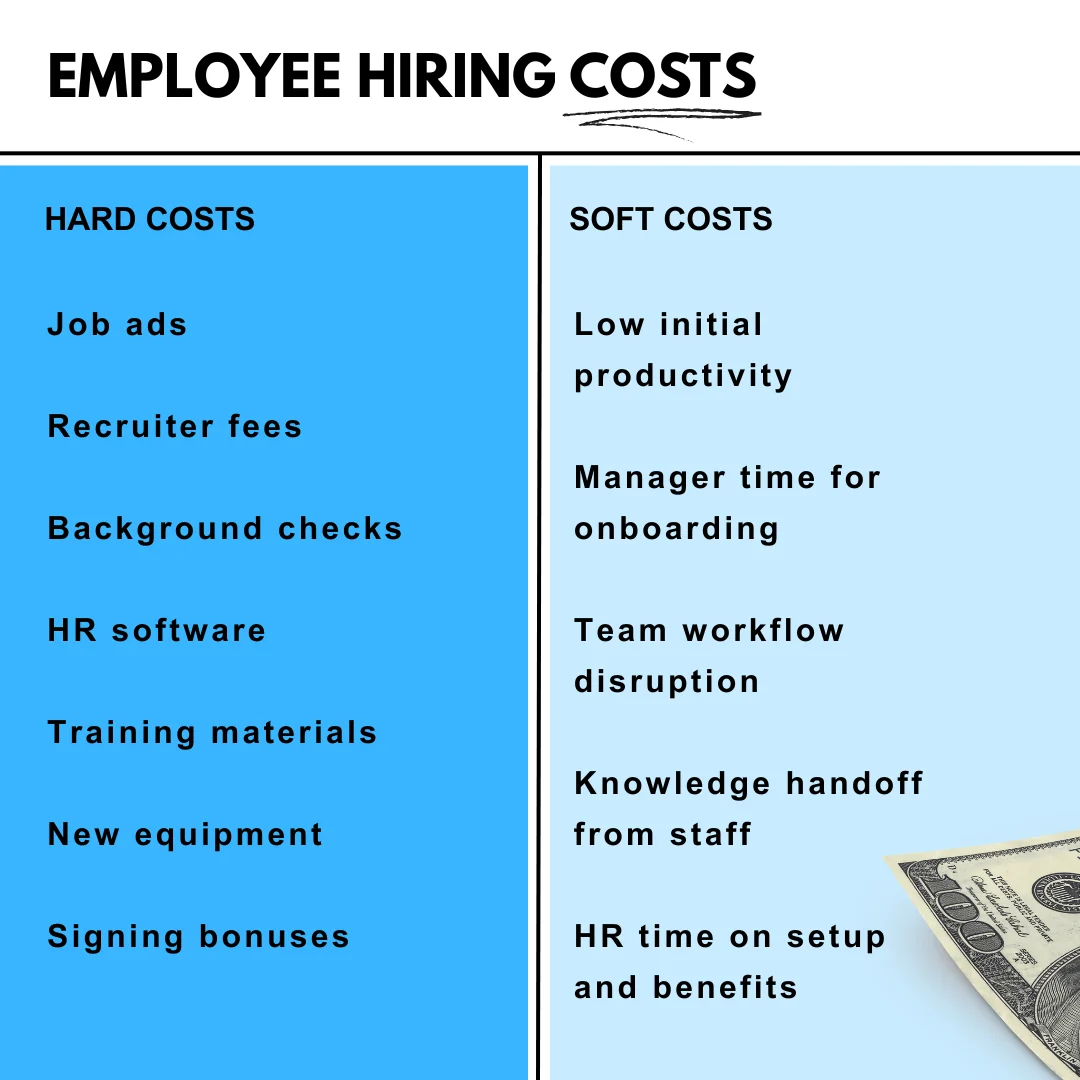

When most businesses think about hiring costs, they start with salary. But salary is just one piece. The true cost of bringing on a new employee includes a mix of hard costs you can track in your budget—and soft costs that quietly chip away at productivity and time.

Hard Costs

These are the direct, visible expenses tied to sourcing, selecting, and onboarding a new employee. They include:

- Job ads and postings (LinkedIn, Indeed, niche boards)

- Recruiter or agency fees

- Pre-employment testing and background checks

- HR software (ATS, payroll, onboarding tools)

- Training programs and materials

- New equipment and software (laptops, licenses, etc.)

- Signing bonuses and relocation stipends

Soft Costs

These costs aren’t always tracked—but they’re real. Soft costs affect productivity, morale, and team dynamics. Key soft costs include:

- Lost productivity while the new hire ramps up (typically 25% productivity in month one)

- Time spent by managers in interviews, onboarding, and mentorship

- Disruption to team workflows as a new employee gets acclimated

- Knowledge transfer from experienced employees to new hires

- HR and admin involvement in setup, benefits, and documentation

Real-World Hiring Cost Range

Combining hard and soft costs, here’s a rough range of what businesses spend per new hire in 2025:

- Entry-level roles: $3,000 – $6,000

- Mid-level roles: $6,000 – $12,000

- Technical roles (e.g. engineers): $10,000 – $20,000+

- Executive hires: $25,000 – $50,000+

Keep in mind: companies in high-cost cities or industries with tight labor markets may see these numbers go even higher. Every hire is an investment—understanding the true cost is the first step in managing it wisely.

Cost Per Hire Formula (With Example)

Whether you're hiring one person or fifty, knowing your cost per hire (CPH) is essential. It helps you budget smarter, measure HR efficiency, and identify areas to optimize your recruitment process.

The Basic Formula

Here’s the standard cost per hire formula:

Cost Per Hire = (Internal Recruiting Costs + External Recruiting Costs) ÷ Total Number of Hires

What Counts as Internal vs. External?

- Internal costs: HR salaries, interview time, ATS software, training

- External costs: Recruiter/agency fees, job board ads, background checks

Small Business Example

Let’s say a small business spends:

- $3,500 on job ads, pre-hire tests, and background checks

- $2,500 worth of time from managers and HR staff

- They hire 2 employees

Their cost per hire would be:

($3,500 + $2,500) ÷ 2 = $3,000 per hire

Enterprise Example

A larger company with an internal talent acquisition team spends:

- $100,000 annually on HR salaries and hiring tools

- $75,000 on external recruiting services

- They hire 50 employees

Cost per hire calculation:

($100,000 + $75,000) ÷ 50 = $3,500 per hire

TIMECLICK TIP

Track your cost per hire quarterly or annually to spot trends. A rising CPH could mean inefficiencies—or a sign that you’re investing in better hires. Either way, it’s a key metric to watch.

Cost Breakdown by Role

Not all hires cost the same. The total investment to bring someone onboard varies widely depending on the role, industry, seniority, and competition for talent. Here’s a closer look at average cost ranges based on role type in 2025.

| Role | Estimated Cost Per Hire (2025) | What’s Driving the Cost? |

|---|---|---|

| Customer Support | $3,000 – $6,000 | High volume hiring, low sourcing complexity, shorter onboarding |

| Sales Representative | $7,000 – $15,000 | Extensive onboarding, performance-driven hiring, turnover risk |

| Software Engineer | $8,000 – $20,000 | Tight labor market, niche skills, time-intensive vetting |

| Marketing Manager | $6,000 – $12,000 | Assessment-heavy, role fit critical for ROI |

| Executive (VP / C-Level) | $25,000+ | Extensive recruiting, search firm involvement, long time-to-hire |

Keep in mind these are just averages. Your costs will vary based on your industry, location, sourcing strategy, and how streamlined your hiring process is.

TIMECLICK TIP

If you're hiring multiple roles each year, break down your cost per hire by job type. It’ll help you forecast more accurately and improve ROI on recruiting spend.

External vs Internal Hiring Costs

One of the biggest drivers of cost-per-hire is how you staff your hiring process. Should you rely on an internal HR team—or bring in external help like recruiters or agencies? The answer depends on your hiring volume, budget, and in-house capabilities.

Internal Hiring Costs

When hiring is handled by your in-house HR or talent acquisition (TA) team, your cost-per-hire typically includes:

- Salaries and benefits for HR staff

- Recruitment advertising costs

- ATS or hiring software subscriptions

- Interview coordination and manager time

- Onboarding and training costs

💡 Average cost-per-hire for internal teams: $4,000 – $7,000 per employee

External Hiring Costs

External hiring support—such as staffing agencies or contract recruiters—can speed up hiring and save time for small teams. However, it often comes with higher upfront costs.

- Agency fees (typically 15%–25% of first-year salary)

- Executive search firm retainers

- Freelance recruiter hourly rates

- RPO (recruitment process outsourcing) packages

💡 Typical external recruiter fees:

| Salary Level | 15% Fee | 20% Fee | 25% Fee |

|---|---|---|---|

| $50,000 | $7,500 | $10,000 | $12,500 |

| $75,000 | $11,250 | $15,000 | $18,750 |

| $100,000 | $15,000 | $20,000 | $25,000 |

When Does Outsourcing Make Sense?

- You’re hiring for a hard-to-fill role (engineering, executive, etc.)

- You lack internal HR bandwidth

- You’re scaling quickly and need speed

- You want help navigating international labor markets

TIMECLICK TIP

If you’re hiring fewer than 10 employees a year, outsourcing can be cost-effective. But if you’re hiring regularly, building an in-house team typically pays off long-term.

Other Hidden Costs You Might Be Missing

Even after you factor in salary, benefits, and recruitment fees, there’s a whole category of hidden hiring costs that can quietly drain your budget. These are harder to quantify—but just as real.

1. Turnover and Replacement Costs

Hiring the wrong person doesn’t just waste money—it costs more to fix. According to SHRM, the cost of replacing an employee can be 1.5x to 2x their annual salary. And if the wrong hire hurts morale or slows down your team, the damage multiplies.

- Lost productivity while rehiring

- Re-training a replacement

- Internal burnout from picking up the slack

- Damage to culture or team trust

2. Culture Misalignment

If someone has the right skills but doesn't fit your company culture, the long-term cost can be huge. These hires often leave early—or cause friction with other team members—leading to churn and instability.

Tip: Bake culture fit into your hiring process by being clear about your values and expectations during screening and interviews.

3. Productivity Lag

New hires don’t hit peak productivity overnight. In fact, research from Harvard Business School shows it can take 12+ weeks for someone to fully ramp up. Until then, your company is investing more than it’s getting back.

| Weeks on the Job | Estimated Productivity | Lost Productivity Cost |

|---|---|---|

| 1–4 weeks | 25% | 75% of salary |

| 5–8 weeks | 50% | 50% of salary |

| 9–12 weeks | 75% | 25% of salary |

| After 12 weeks | 100% | 0% |

For roles with longer learning curves—like engineering, product, or leadership—this ramp-up period is even longer.

4. Overhead and Equipment

Each new hire brings additional costs for workspace, IT gear, tools, and software licenses. Whether remote or in-office, you’ll likely spend:

- $1,000–$3,000 for hardware and equipment

- $20–$100 per month in software and SaaS tools

- Extra office space and facilities (if on-site)

5. Compliance and Legal Risk

If you misclassify an employee or fail to meet state/federal labor requirements, hiring can get expensive fast. Mistakes in payroll, documentation, or onboarding processes can lead to audits, penalties, or lawsuits.

TIMECLICK TIP

Don’t overlook onboarding as a compliance step. Use digital checklists or HR software to track policies, signatures, and tax forms from day one.

Simplify Time Tracking with TimeClick!

Download our free trial—simple, secure, offline tracking, no fluff.

How to Reduce Hiring Costs Without Cutting Corners

Cutting hiring costs doesn’t mean settling for less talent. It means making smarter decisions—upfront and throughout your recruitment process. These strategies help you save money while improving quality of hire.

1. Use Skills-Based Hiring

Instead of relying solely on resumes, filter candidates using job-specific skill tests or real-world tasks. This shortens the screening process, reduces the chance of bad hires, and helps you focus only on qualified candidates.

- Fewer unqualified interviews

- Faster shortlisting

- More predictive than resumes or education requirements

2. Write Crystal-Clear Job Descriptions

Unclear or overly generic job posts attract the wrong candidates—leading to wasted time and higher churn. A precise, honest job description helps filter the right people from the start.

Tip: Include responsibilities, required skills, work environment, growth path, and pay range.

3. Streamline Your Interview Process

Dragging out the hiring process frustrates candidates and inflates internal costs. Use structured interviews, limit the number of interview rounds, and make faster decisions.

- Use consistent questions to evaluate fairly

- Limit interviews to 2–3 key stakeholders

- Make decisions within 5–7 days post-final interview

4. Automate Onboarding

Manual onboarding eats up HR time and delays productivity. Switching to automated onboarding systems—whether it’s software or standardized checklists—reduces admin work and gets new hires up to speed faster.

Benefits: Faster ramp-up, fewer compliance mistakes, better first impressions.

5. Build a Talent Pipeline

Don’t wait until a position is open to start sourcing. A proactive talent pipeline reduces time-to-fill and lets you hire without expensive last-minute spending on ads or agencies.

- Keep a list of promising past applicants

- Engage passive talent through newsletters or LinkedIn

- Invest in employer branding to draw applicants organically

6. Track Cost Per Hire (and Optimize)

You can’t reduce what you don’t track. Monitoring cost-per-hire across roles, sources, and time periods shows you where money is going—and where you can get more efficient.

TIMECLICK TIP

Many applicant tracking systems (ATS) or time tracking tools integrate with your hiring stack to help you measure costs, time-to-hire, and ROI for each recruiting channel. Start there.

Free Hiring Cost Calculator

Want a quick way to estimate your hiring expenses? Use our free cost-per-hire calculator to break down exactly how much it costs to bring a new employee on board—from salary and software to training and time.

No email required. No guesswork. Just real numbers.

What You’ll Need

- Base salary for the role

- Estimated spend on job ads, software, recruiters, and training

- Time spent by HR and hiring managers

Once you enter your numbers, you’ll get an instant cost-per-hire estimate—plus ideas to reduce costs without compromising quality.

TIMECLICK TIP

Use the calculator before budgeting for new hires or pitching headcount increases. It’s an easy way to bring hard numbers to your planning process.

U.S. Hiring Cost Compliance Factors

Beyond salary and perks, U.S. employers are legally responsible for a number of compliance-related hiring costs. These aren’t optional—skip them and you risk audits, fines, or even lawsuits. Below is a breakdown of the most important legal obligations that affect the true cost of hiring in the United States.

1. Payroll Taxes (FICA)

Employers must match employee contributions to Social Security and Medicare under the Federal Insurance Contributions Act (FICA). As of 2025:

- 6.2% of wages go to Social Security (up to $168,600 wage base)

- 1.45% of wages go to Medicare (no income cap)

There’s also an additional 0.9% Medicare surtax for high earners, but only employees pay that.

2. Federal and State Unemployment Taxes (FUTA/SUTA)

Employers must pay federal unemployment tax (FUTA)—6.0% on the first $7,000 of each employee’s wages. In practice, most employers receive credits that reduce this to 0.6%.

State unemployment taxes (SUTA) vary widely. Rates range from 0.5% to over 9%, and wage bases vary by state (e.g., $7,000 in Florida vs. nearly $50,000 in Idaho).

3. Workers’ Compensation Insurance

This is mandatory in nearly every state and covers employees injured on the job. Rates depend on location, industry risk level, and payroll. For example, clerical work might cost $0.20 per $100 in payroll, while construction could be $10 or more per $100.

4. Overtime & Wage Rules

The federal minimum wage is $7.25/hour, but many states set higher rates. You’ll also need to comply with federal overtime laws—generally time-and-a-half for hours over 40/week—and make sure exempt employees meet minimum salary thresholds (currently $684/week for most exempt roles).

5. Required Leave Laws (FMLA, State Mandates)

- FMLA: 12 weeks of unpaid, job-protected leave for qualifying family or medical needs (for employers with 50+ employees)

- State laws: Some states require paid family, medical, or sick leave. For example, California and New York have state-mandated programs funded by employer and/or employee contributions.

6. Retirement Plan Requirements

There’s no federal mandate to offer retirement plans—but 10+ states now require employers to enroll employees in state-run programs (e.g., CalSavers in California, OregonSaves). If your business doesn't offer a private plan, you may be required to register for the public one.

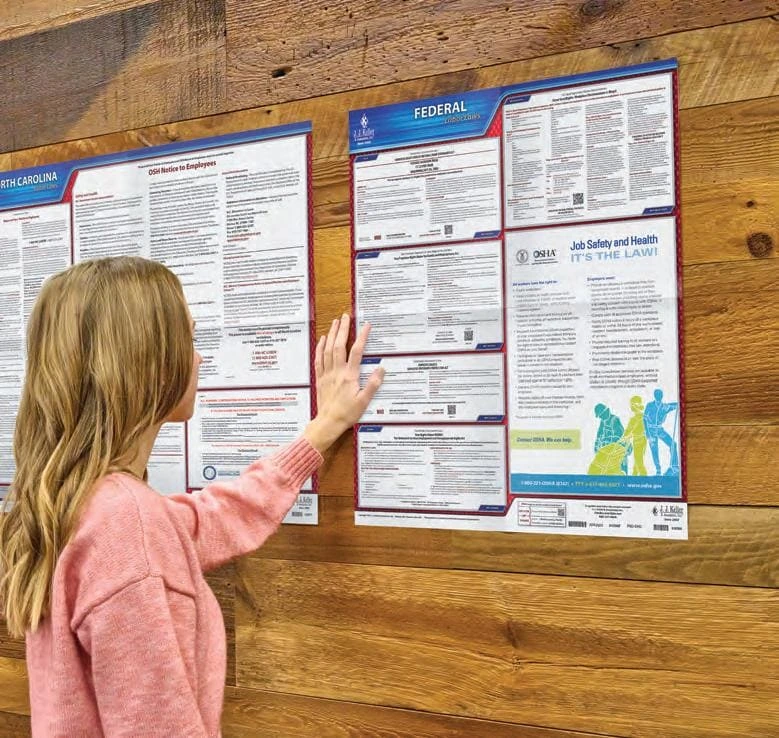

7. Mandatory Postings & Recordkeeping

You must display updated labor law posters in a visible location and maintain certain payroll and employment records for multiple years to comply with Department of Labor audits.

TIMECLICK TIP

If you're hiring in multiple states, make sure you understand each state’s unique requirements. A compliant hiring process in Texas could leave you exposed in California or New York. Consider working with an employment attorney or HR compliance software.

What Is a Fully Loaded Cost?

The fully loaded cost of an employee includes all these mandatory expenses—plus salary, bonuses, equipment, and overhead. In many industries, this can drive the total cost to 1.25 to 1.5x the base salary or more.

Failing to account for compliance-related costs doesn’t just hurt your budget—it can hurt your business. Plan proactively, budget accurately, and use tools like our Hiring Cost Calculator to model real-world hiring scenarios.

Final Thoughts: Spend Smarter, Hire Better

Hiring isn’t cheap—but done right, it’s an investment that pays off. The true cost of bringing on a new employee goes well beyond salary and perks. Between recruiting, compliance, onboarding, training, and lost productivity, it’s easy to underestimate what hiring actually costs until it hits your bottom line.

That’s why tracking your cost-per-hire isn’t just an HR exercise—it’s a business necessity. It helps you:

- Set realistic hiring budgets

- Forecast headcount growth more accurately

- Spot inefficiencies in your recruiting funnel

- Compare internal vs. external hiring strategies

- Align HR goals with broader business KPIs

But don’t make the mistake of optimizing for cost alone. A cheaper hire isn’t always a better one. Poor hiring decisions lead to high turnover, cultural friction, and lost productivity—all of which cost more over time. Smart hiring is about balance: cost efficiency and long-term fit.

If you’re hiring in 2025, focus on the levers you can control: tight job descriptions, better screening, streamlined interviews, and onboarding that actually sets people up to succeed. Use tools like our Hiring Cost Calculator to budget wisely—and don’t be afraid to spend a little more on candidates who raise the bar.

TIMECLICK TIP

Look beyond cost per hire alone. Monitor quality of hire, retention rates, and time to productivity to get the full picture of hiring ROI.

Hiring is one of the most important business decisions you’ll make. Plan for it, budget for it, and do it with intention—and you’ll build a team that drives real results.

Ready to Stop Guessing—and Start Hiring Smarter? You’ve seen how quickly hiring costs add up. Now see how fast they can come down. Try TimeClick free for 14 days—no credit card required.

Start your FREE TimeClick Trial Today.