You serve customers. You manage employees. You purchase materials and possess the knowledge and skills to turn them into sellable products. When it comes to the books, however, should you hire an accountant or do it yourself?

Let’s face it – if it really came down to it, you could likely figure out the process of accounting your business finances and do it yourself. Let’s explore the pros and cons of both to see what may best fit your business.

Why is Accounting a Big Deal?

Imagine you finally booked a trip to the destination of your dreams after months or years of saving. You excitedly arrive at the airport, get through security and board the airplane after stowing your luggage.

You sit down, settle yourself and perk up as the intercom crackles to life. You hear the pilot say, “Alright everyone! Welcome aboard. In interest of honesty, I’m not really sure how much fuel we have left, but we should be able to make it overseas!”

You could likely run into a similar situation with your business by way of negligent or inaccurate accounting.

In fact, Devry University even suggests following sound accounting principles for personal finances. You stand only to benefit from keeping accurate tabs on your cashflow.

Empowering the Individual

We’ve already established the importance of accurate accounting. You may wonder what to do next – is it time to buy a calculator?

Don’t worry if math was not your favorite subject in school. It wasn’t mine either.

Today, copious resources and tools exist to help make accounting easier. With a huge array of products to choose from, business owners in 2022 can get the job done like never before.

Perhaps the most well-known of all, QuickBooks represents one such option for small business owners.

Products such as these allow you to manage your finances yourself. Additionally, many companies also provide helpful guides and tips to get you started.

Advantages of Doing it Yourself

Let’s take a step back and break down the key benefits of handling accounting yourself.

On-Demand Work

Once you learn and understand how to use the accounting system of your choice, you can hit the books whenever you need.

Need to check if you can make a purchase? Want to see your budget for hiring a new employee? Need to prepare your taxes for the year?

You can answer all of these questions yourself without the need for finding an accountant, booking an appointment, and waiting for the results.

Potentially Reduced Costs

The startup cost of accounting systems can represent another point of attraction. For instance, the most affordable Quickbooks plan starts at $12.50/month.

In this way, knowing how to account properly can potentially save you thousands that you would have spent paying an accountant to do it for you.

Why Should I Hire an Accountant?

With the points we’ve explored thus far, you may lean towards trying out an accounting system yourself. How do CPAs, accountants, and bookkeepers still have employment and make money, then?

Advantages of Hiring an Accountant

Of course, multitudes of people make a decent living in the accounting field. Let’s dive a bit deeper – should you hire an accountant?

Save Your Time

Passing the books to someone else means you don’t have to sit down and spend your time plugging numbers. This may not seem like a big deal at first, so let’s dive into why this is important.

As the old saying goes, time is money. Forbes cites the average worth of an hour at $170 for a small business owner.

Even if your business doesn’t generate as much revenue as others, your time could still exceed $50 per hour in worth.

As a result, though you may only spend $12.50 on the most affordable QuickBooks plan, the time you spend can cost you much more.

Ensure Accuracy

CNBC reports 44% of small business owners in the United States to have higher education degrees. Of those people with degrees, what do you think the chances are of them having studied accounting?

The point here centers on the fact that most small business owners don’t possess accounting expertise. Of course, you could gain that expertise to do your own accounting.

Given that you only use free resources, how long do you think it could take for you to understand accounting enough to do it accurately?

Even if you do understand accounting to feel confident about doing it yourself, making a mistake can cost you. Let’s look at the possibilities you could face from an accounting mishap:

-

- Miscalculation of expenses and revenue can increase your overhead and reduce profits

-

- Your business credit could suffer, potentially reducing credit limits and increasing interest rates

-

- You could trigger a business audit from the IRS

Different Methods

As you consider the previous points on hiring an accountant, you must also consider the different pathways that exist to that end.

Generally, small business owners have at least three options for hiring an accountant: hiring an in-house bookkeeper, an off-site accountant, or a Certified Public Accountant.

The main differences at play involve cost and expertise.

An in-house bookkeeper may not cost as much as a CPA since you don’t have to require education or certification, but may yield slower or potentially less accurate work.

On the flip side, a CPA could cost you a lot more than a family member or a local applicant, but provide assurance of prompt, high-quality work.

A Cost Evaluation

This may take some time for you to crunch the numbers and figure out the best solution for your needs. To help make the decision, you should first calculate average daily revenue so you can judge an estimate of your hourly value.

Take your time and factor in as many details as you can to make sure your estimates are as accurate as possible. Once you have a rough hourly worth for your time as the business owner, you can start comparing the costs.

You should estimate the amount of time you think you’ll need to learn the accounting system of your choice. Then add the amount of time you’ll need to spend regularly handling your business accounting.

Multiply the total number of hours by your hourly worth and add the cost of your accounting product for a total cost of doing it yourself.

Here’s an example.

Let’s say you run a bakery that generates $1000 a day. You spend about 10 hours a day running your business from prep to closing, so your hourly worth sits at $100/hour.

You decide on the most affordable plan for QuickBooks and spend 2 hours learning the software. You then spend an average of 10 hours per month managing the books yourself.

The cost for the first month of doing it yourself with these numbers totals at $1212.50. This is the number you should then compare so you can decide on the question: should you hire an accountant.

Conclusion

Accounting is a necessary, yet time-consuming function of any small business. Should you decide that doing it yourself represents the better option, a quick Google search will yield a plethora of tools and resources.

Be sure to closely compare the available products to choose one with the features you need for your business.

On the other hand, hiring an accountant can not only save you time, but money as well, depending on the daily revenue and hourly worth of your time as a business owner.

Account for Employee Expenses Quickly and Easily

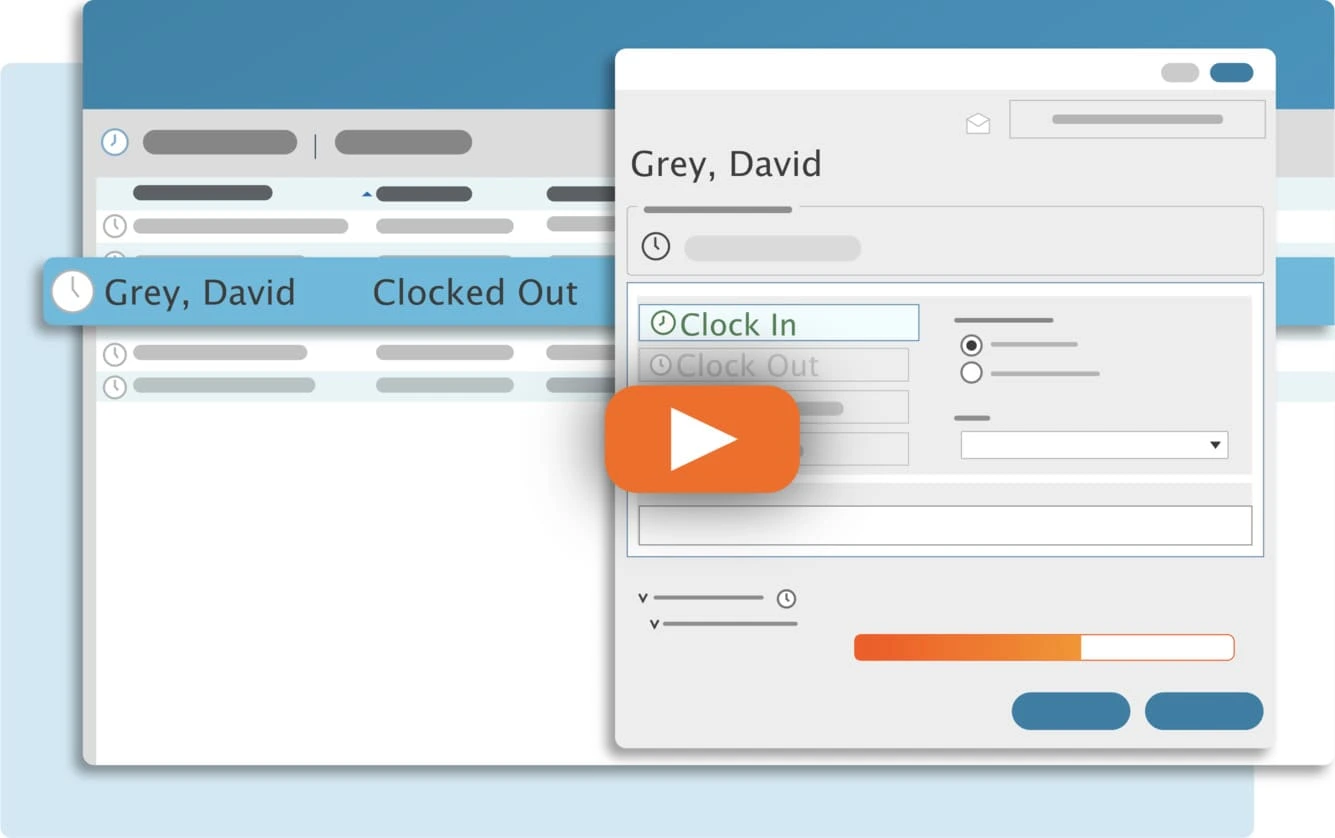

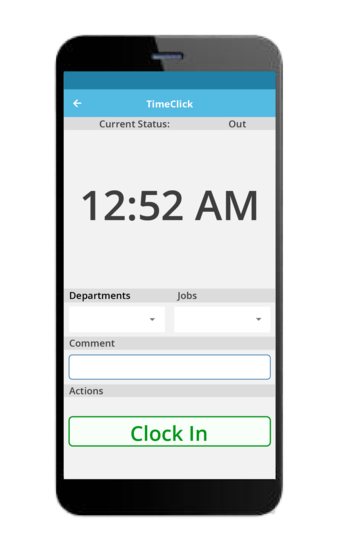

With that said, we have the perfect solution to managing employee payroll expenses: TimeClick 21. As a simple, yet powerful time clock solution, TimeClick allows your employees to clock in and out with ease.

You can then run customizable reports to send over to your accountant or to plug into your books for your accounting purposes.

If you have any questions about how TimeClick can help, give us a call at (435) 753-4102, chat with a five-star support rep, or email us at sales@timeclick.com.

Ready to streamline your employee time tracking, boost productivity, and simplify payroll? Sign up for your FREE 14-day trial today and see how TimeClick can transform your business!

Start your FREE TimeClick Trial Today.