Tracking employee hours isn’t just about running payroll - it’s about staying on the right side of the law. If you’re a small business owner, you’re expected to follow the same wage and hour rules as the big guys, and slipping up can lead to fines, back pay, or even a lawsuit.

The Fair Labor Standards Act (FLSA) lays out the federal rules for time tracking, overtime, and recordkeeping. But that’s just the beginning.

Many states layer on their own requirements like paid breaks, daily overtime, or stricter documentation. Keeping up with all of it can be a challenge, especially if you’re wearing multiple hats.

This guide walks you through what you need to know to stay compliant, including:

- What the law requires at both the federal and state levels

- Smart, simple ways to keep accurate records

- Common pitfalls that get small businesses in trouble

- How TimeClick can make compliance a whole lot easier

Let’s break it down and help you get your time tracking system running smoothly - without the legal headaches.

Table of Contents

- Why Time Tracking Compliance Matters

- Key U.S. Time Tracking Laws

- Fair Labor Standards Act (FLSA)

- Exempt vs. Non-Exempt Employees

- Overtime Requirements

- Rounding Time Entries

- What Counts as “Hours Worked”

- Record Retention

- State and Local Laws

- Best Practices for Staying Compliant

- Use a Reliable Time Tracking System

- Track Breaks, Overtime, and Off-the-Clock Work

- Store and Audit Your Records

- Train Managers and Employees

- Common Compliance Mistakes to Avoid

- How TimeClick Supports Compliance

- Accurate Time Capture

- Audit-Ready Records

- Built-In Rules for Overtime and Breaks

- Secure, Centralized Recordkeeping

- Payroll Integration

- Frequently Asked Questions

- Conclusion

Why Time Tracking Compliance Matters

Time tracking might feel like a small task, but it has big consequences. If you’re not keeping accurate records, your business could face fines, lawsuits, or back pay claims - even if the mistake was unintentional.

Federal law (specifically the FLSA) says employers have to track hours worked for non-exempt employees. That includes when they clock in and out, how long they take for lunch, any overtime they earn, and how much they’re paid. It doesn’t matter if you trust your team or run a tight ship - if the records aren’t there, it’s a problem.

Some states take it even further. You might be required to give paid rest breaks, track meal times, or follow stricter documentation rules. And if you’re not aware of those state-specific laws, you could be out of compliance without even knowing it.

Keeping good records helps you:

- Stay out of legal trouble

- Make sure employees get paid correctly

- Be ready if there’s ever an audit or complaint

- Run payroll more smoothly

It doesn’t have to be complicated or time-consuming. With a simple system in place, you can stay compliant and keep your business running without the stress.

Key U.S. Time Tracking Laws

If you run a business in the U.S., there’s one law you absolutely need to know when it comes to tracking employee hours - the Fair Labor Standards Act (FLSA).

It applies to most employers and sets the foundation for how you handle wages, overtime, and recordkeeping.

Fair Labor Standards Act (FLSA)

The FLSA requires you to maintain accurate records for all non-exempt employees. In plain terms, you’ll need to track:

- When employees start and finish work each day

- Total hours worked per day and per week

- Meal and rest breaks (if applicable)

- Overtime hours and pay

- Any bonuses, deductions, or changes in pay rate

You can use whatever system works best - paper timesheets, punch clocks, or time tracking software.

What matters is that your records are clear, accurate, and easy to produce if the Department of Labor ever asks to see them. Most records must be kept for at least three years.

Exempt vs. Non-Exempt Employees

Non-exempt employees are the ones who qualify for overtime - and they’re the ones whose hours you must track.

Paying someone a salary doesn’t automatically make them exempt. The law looks at what they do and how much they earn, not just how they’re paid. Misclassifying employees can lead to expensive penalties.

Overtime Requirements

Federal law says that non-exempt employees must earn 1.5x their regular pay rate for any hours worked over 40 in a single week.

You can’t average hours between weeks or give time off in place of overtime pay (unless you’re a public employer).

That’s why accurate time tracking is essential - estimates or guesswork won’t hold up.

Rounding Time Entries

You can round time entries, but only if the process is fair. Rounding to the nearest 5, 10, or 15 minutes is fine - as long as it doesn’t consistently benefit the employer.

If your rounding regularly shortchanges employees, you could face compliance issues.

What Counts as “Hours Worked”

Federal law requires you to pay employees for all the time they’re “suffered or permitted” to work - not just their scheduled shifts. That includes:

- Setup or cleanup time before or after a shift

- Mandatory meetings, training, or prep work

- Short rest breaks (under 20 minutes)

- Any work done during unpaid meal breaks

If an employee is doing something job-related, that time counts - and it must be tracked and paid.

Record Retention

Once you’re tracking time, you also need to keep those records organized and backed up.

The Department of Labor can request them at any time, so make sure they’re complete and easy to access.

Here’s how long you should hold onto different records:

- Payroll records - Keep for at least 3 years. Includes pay rates, hours, deductions, and bonuses.

- Time cards and daily/weekly totals - Keep for at least 2 years. Include start/end times, breaks, and total hours.

- Work schedules - Save for 2 years. These show planned hours and help verify overtime or attendance.

- Wage calculation records - Keep for 2 years. Includes time sheets, commission details, or pay formulas.

- Employee information - Keep for at least 3 years. Includes name, address, job title, and date of birth (if under 19).

- Employment agreements and contracts - Keep for at least 3 years. Includes written contracts, commission plans, or union agreements.

If you hire minors, you’ll also need to track their date of birth and follow youth labor laws about shift length and timing.

Learn more at YouthRules.gov.

Some states - like California or New York - require you to store records longer or include additional details.

When state and federal laws differ, always follow the one that gives the employee more protection.

For full details, visit the official DOL reference: FLSA Recordkeeping (Fact Sheet #21).

TIMECLICK TIP

Even if you’re using spreadsheets or paper timesheets, save a copy for every pay period - digitally or physically.

If you’re ever audited, those records will be your best defense.

State and Local Laws

Federal law sets the minimum, but many states go further.

California, for example, requires daily overtime after 8 hours and enforces strict meal and rest break rules. Other states may require paid sick leave or advanced scheduling notices.

If state and federal laws conflict, the one that benefits the employee usually applies.

Best Practices for Staying Compliant

Following the law is the baseline. If you want to avoid surprises - like a wage complaint or an audit - be proactive. The clearer and more consistent your time-tracking process is, the fewer problems you’ll run into later.

These simple habits can save time, money, and stress.

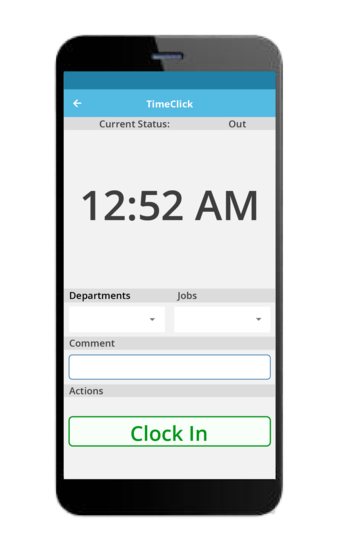

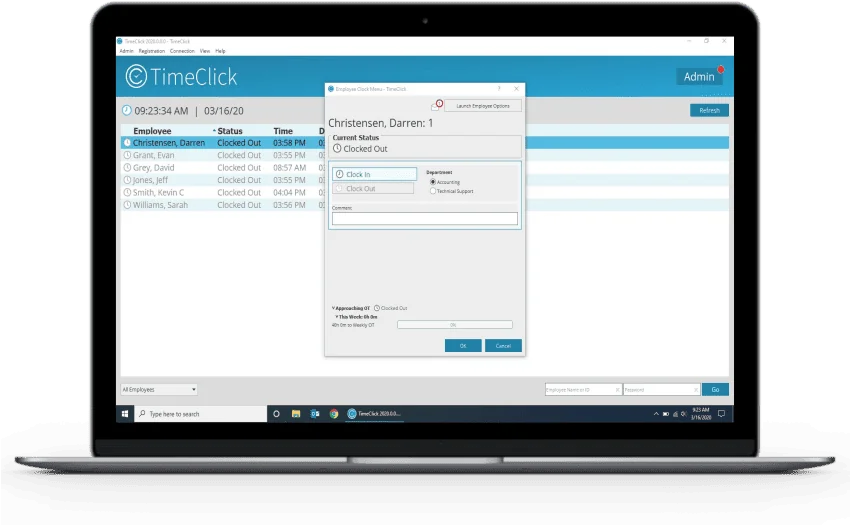

Use a Reliable Time Tracking System

However you track time - physical clock, software like TimeClick, or even a spreadsheet - it has to be accurate.

Record actual start and end times, breaks, and time off. If you round, use neutral rounding (to the nearest 5, 10, or 15 minutes) and make sure it doesn’t consistently favor the employer.

TIMECLICK TIP

TimeClick captures timestamps automatically and flags missing punches, which helps reduce errors and calculate overtime correctly.

Track Breaks, Overtime, and Off-the-Clock Work

Breaks matter. Short paid breaks - like quick coffee stops - count as work time. Meal breaks are unpaid only if the employee is completely off duty. If someone checks email during lunch or handles a task before/after a shift, that time is paid and should be recorded.

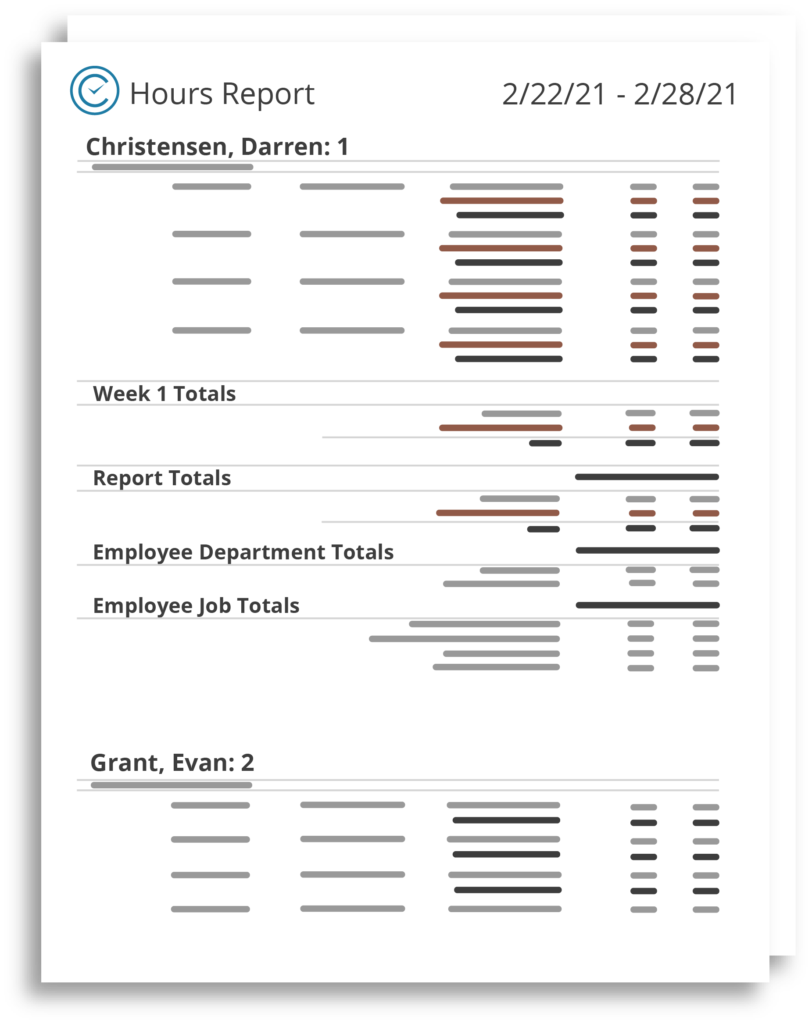

Store and Audit Your Records

Keep all time records in one place and retain them for at least three years. A digital system with backups and edit logs makes this easy. Run regular audits to spot gaps, rounding patterns, or edits that could raise questions later.

Train Managers and Employees

Make sure everyone understands the process. Employees should know how to log hours and fix mistakes. Managers shouldn’t change entries to cut payroll. Clear policies - and quick check-ins each pay period - keep things consistent and compliant.

TIMECLICK TIP

Ask employees to review and confirm their time at the end of each pay period. It catches mistakes early and adds an extra layer of protection if a dispute comes up.

Common Compliance Mistakes to Avoid

You don’t have to be cutting corners to run into trouble. Even small, unintentional mistakes in time tracking can cause legal problems and unnecessary costs.

Here are some of the most common slip-ups small businesses make - and why they can come back to haunt you.

| Mistake | Why It’s a Problem |

|---|---|

| Misclassifying employees as exempt | If someone doesn’t actually qualify as exempt, you could owe years of unpaid overtime - plus penalties. |

| Not recording off-the-clock work | Work done before or after a shift, or during breaks, still counts. If it’s not recorded, it’s unpaid time. |

| Auto-deducting unpaid meal breaks | If employees work through lunch - even briefly - that time must be paid. Automatic deductions often lead to underpayment. |

| Ignoring remote or after-hours work | Answering emails at home or taking a quick call after hours still counts as paid time under federal law. |

| Using inaccurate or outdated records | If your records aren’t complete or current, you’ll have little defense during an audit or employee complaint. |

| Overlooking state-specific rules | Some states require daily overtime, additional breaks, or detailed recordkeeping. Missing those details can double your legal trouble. |

Most of these mistakes are easy to prevent once you know what to watch for. With clear policies, good training, and a reliable system in place, you can catch problems early and stay compliant without the stress.

TIMECLICK TIP

TimeClick automatically records every punch, flags missing entries, and logs all edits - so you always have an accurate, trustworthy record if questions ever come up.

How TimeClick Supports Compliance

TimeClick helps small businesses stay compliant without the hassle. It gives you the accuracy, control, and recordkeeping you need to meet federal and state labor laws - without adding more work to your plate.

Accurate Time Capture

Every clock-in, clock-out, and break is automatically time-stamped down to the minute. Whether employees are on-site or remote, TimeClick records their hours precisely so you always know your data is accurate.

Audit-Ready Records

TimeClick logs every punch, edit, and user action. If you’re ever audited or handling a wage dispute, you’ll have organized, easy-to-read records showing exactly what happened and when.

Built-In Rules for Overtime and Breaks

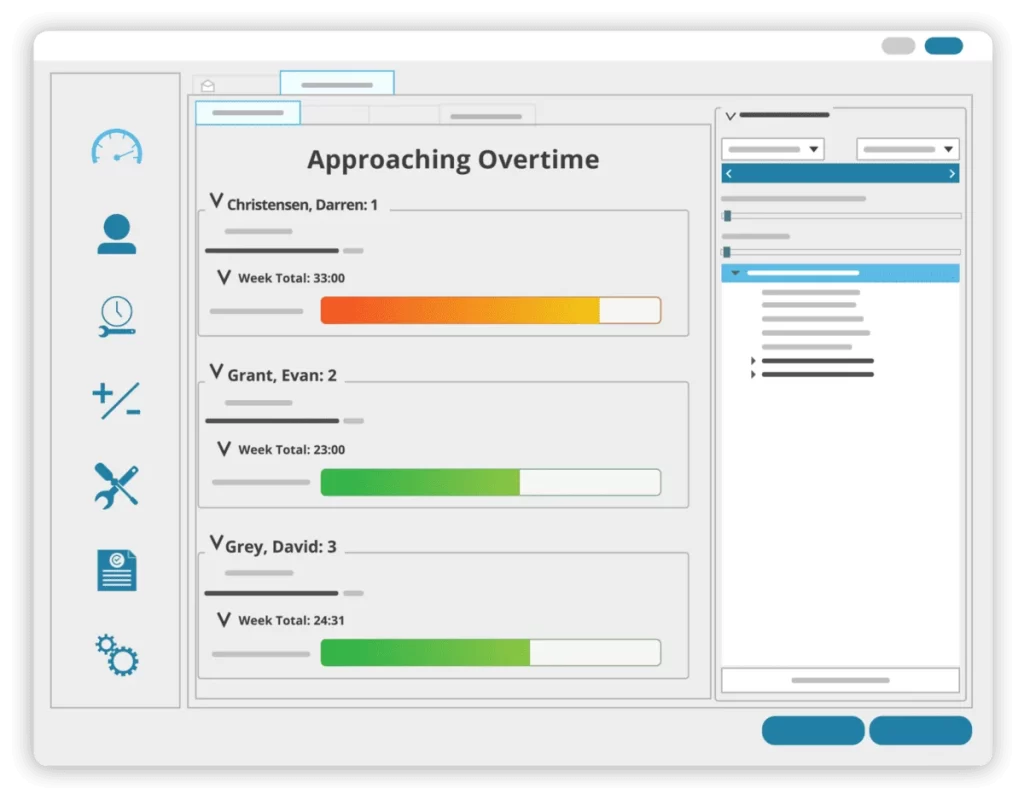

You can set TimeClick to follow both federal and state labor rules - like overtime thresholds and required breaks. It can flag missing punches or alert you when an employee is nearing overtime, giving you time to fix issues before they become problems.

Secure, Centralized Recordkeeping

All your employee time data lives in one secure place. No need to shuffle through old spreadsheets or folders - everything is accessible right from your dashboard when you need it.

Payroll Integration

TimeClick connects directly with major payroll platforms to eliminate manual entry and reduce mistakes. Hours and overtime sync automatically, making payroll faster and more accurate.

Frequently Asked Questions

Still have questions? Here are quick answers to some of the most common time tracking and compliance concerns.

Do I need to track hours for salaried employees?

Only if they’re classified as non-exempt. A salary alone doesn’t make someone exempt from overtime. If they don’t meet the federal exemption criteria, you’re required to track their hours just like hourly workers.

Can I round employee time entries?

Yes, but be fair. You can round to the nearest 5, 10, or 15 minutes - as long as it averages out and doesn’t consistently benefit the employer.

How long should I keep time records?

The FLSA requires keeping payroll records for at least 3 years and time cards or schedules for at least 2. Some states require longer, so check your local rules.

Can I automatically deduct meal breaks?

You can, but it’s risky. If an employee works through part of their break - even briefly - that time must be paid. It’s better to have them clock out and back in so your records reflect what actually happened.

What counts as off-the-clock work?

Any job-related task done before clocking in, after clocking out, or during an unpaid break counts as work time. You’re responsible for paying for it, even if it wasn’t approved first.

Is it okay to use paper timesheets?

Yes, as long as they’re accurate and complete. However, paper systems are easier to lose or miscalculate. Software like TimeClick reduces those risks by tracking everything automatically and keeping secure backups.

What are the penalties for non-compliance?

Failing to follow time tracking laws can lead to back pay, overtime penalties, and sometimes double damages. The Department of Labor can also issue fines - especially for repeat or willful violations.

Conclusion

Staying compliant with time tracking laws doesn’t have to be hard - it just needs the right system in place.

Keeping accurate records of hours, breaks, and overtime protects your business and your employees.

Between federal and state requirements, there’s a lot to juggle. But with the right tools and consistent habits, you can simplify compliance and stay ahead of potential issues.

TimeClick makes that easy. It gives you reliable tracking, precise records, and built-in safeguards so you can focus on running your business - not worrying about compliance problems.

Take the stress out of time tracking. Stay compliant, stay confident, and keep your team moving forward.

Ready to simplify compliance and take the guesswork out of time tracking? Try TimeClick and see how easy it is to track hours, manage records, and stay audit-ready.

Start your FREE TimeClick Trial Today.