If you manage employees in the U.S., understanding the Family and Medical Leave Act (FMLA) isn’t optional, it’s a must. First signed into law in 1993, the FMLA gives eligible workers the right to take unpaid, job-protected leave for family and medical reasons. For employers, it can feel like walking a tightrope between legal compliance and running a business smoothly.

The rules aren’t always straightforward, especially with new updates and overlapping state-level laws in 2026. That’s why we put this guide together. Whether you’re an HR professional, business owner, or office manager, we’ll walk you through everything you need to know about the current FMLA rules, how they work, and what you need to do to stay compliant.

If you want to read the full law straight from the source, visit the U.S. Department of Labor’s FMLA page.

Table of Contents

- What Is the Family and Medical Leave Act (FMLA)?

- Who Is Eligible for FMLA Leave?

- What Conditions Qualify for FMLA Leave?

- How Much Leave Does FMLA Provide?

- Is FMLA Paid or Unpaid?

- Understanding Federal vs. State Family Leave Laws

- How to Apply for FMLA Leave (Employer + Employee Steps)

- Employee Responsibilities

- Employer Responsibilities

- Frequently Asked Questions

- Compliance Best Practices for Employers

- Conclusion

What Is the Family and Medical Leave Act (FMLA)?

The Family and Medical Leave Act (FMLA) is a federal law that gives certain employees the right to take up to 12 weeks of unpaid, job-protected leave in a year for big life events like welcoming a new child, caring for a family member, or dealing with their own serious health condition. It’s been around since 1993 and has helped millions of Americans balance work and family life.

FMLA applies to private employers with 50 or more employees, as well as all public agencies and schools. It was designed to let employees handle things like a new baby, adoption, illness, or caregiving responsibilities without worrying about losing their job or health coverage.

In 2023, the Department of Labor clarified how FMLA applies to remote workers: what matters is the location the employee reports to or gets assignments from, not where they physically work from. That means remote employees can still count toward an employer’s FMLA obligations.

Many states have added their own family and medical leave programs on top of the federal FMLA, and we’ll cover those later in this guide.

Who Is Eligible for FMLA Leave?

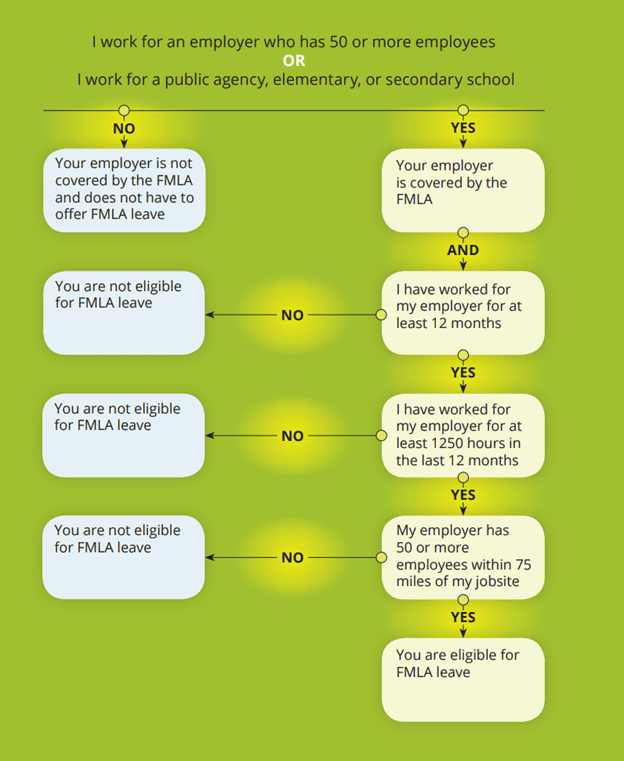

Not every employee automatically qualifies for FMLA leave. The law sets very specific guidelines for both employers and employees. Understanding these rules is key to staying compliant and avoiding penalties.

An employee is eligible for FMLA leave if all of the following are true:

- They work for a covered employer (private company with 50+ employees, public agency, or school).

- They’ve been with the company for at least 12 months (the time doesn’t have to be consecutive).

- They’ve worked at least 1,250 hours in the past 12 months.

- They work at a location where the company has at least 50 employees within a 75-mile radius.

The Department of Labor clarified in 2023 that for remote workers, the “worksite” is the office they report to or receive assignments from — not their home. So, even remote employees can count toward the 50-employee threshold under certain conditions.

Employers must also meet coverage requirements. FMLA applies to private employers with 50 or more employees within 75 miles, and all public agencies and schools. It’s up to the employer to track eligibility and communicate the process clearly to employees.

What Conditions Qualify for FMLA Leave?

FMLA leave is designed for specific life events and medical situations, not just any personal absence. Both employers and employees need to understand what qualifies so expectations are clear and paperwork is handled properly.

Eligible employees can take FMLA leave for any of the following reasons:

- The birth of a child and to care for the newborn within the first year.

- The placement of a child for adoption or foster care and to care for that child within the first year.

- To care for a spouse, child, or parent with a serious health condition.

- To recover from the employee’s own serious health condition that makes them unable to do their job.

- To deal with certain needs arising from a family member’s active duty military service.

- To care for a covered service member with a serious injury or illness (up to 26 weeks).

A “serious health condition” generally means an illness, injury, or condition that involves inpatient care or ongoing treatment by a healthcare provider. In 2022, the Department of Labor clarified that serious mental health conditions — such as severe anxiety, depression, or PTSD — are covered under FMLA, as long as they meet the same treatment standards as any physical condition.

TIMECLICK TIP

Always request proper medical certification when an employee requests leave for a serious health condition. It protects your company and ensures fair treatment across the board.

How Much Leave Does FMLA Provide?

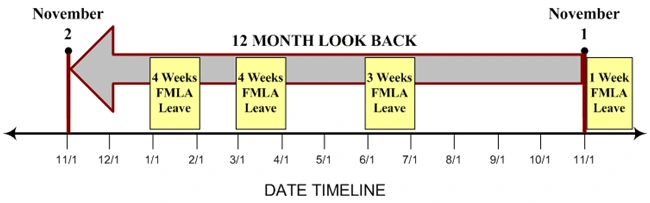

The federal FMLA gives eligible employees up to 12 workweeks of unpaid, job-protected leave within a 12-month period for most qualifying reasons. Employees can take this time all at once or break it up into smaller blocks, depending on their situation and your company’s policies.

Employers have some flexibility in how they define that 12-month period. Common methods include:

- Calendar year

- Fixed 12-month period, such as your fiscal year

- 12 months measured forward from the first day of FMLA leave

- Rolling 12-month period measured backward from the date leave is taken

There’s one important exception: if an employee is caring for a covered service member with a serious injury or illness, they may take up to 26 workweeks of leave in a single 12-month period.

TIMECLICK TIP

Be clear in your employee handbook about how your company calculates the FMLA leave year. Setting expectations early helps avoid confusion and potential legal problems.

Is FMLA Paid or Unpaid?

One of the most common questions employees ask is whether FMLA leave comes with a paycheck. The federal answer is straightforward: FMLA leave is unpaid. That said, employers can require employees to use any vacation, sick days, or other paid time off (PTO) at the same time as their FMLA leave — unless the employee is already receiving state-paid family leave benefits.

As of 2026, the Department of Labor clarified that if an employee is getting payments from a state-paid leave program, employers can’t force them to use PTO at the same time. However, both sides can voluntarily agree to apply PTO to “top up” the check and get it closer to full wages.

While federal FMLA doesn’t guarantee paid leave, a growing number of states have stepped in with paid family and medical leave programs. These include California, New York, New Jersey, Washington, Massachusetts, Connecticut, Oregon, Colorado, and Washington, D.C. Each offers some form of wage replacement during qualifying leave.

If you have employees in multiple states, it’s essential to keep up with both federal and state requirements. Missing a state-specific rule can lead to compliance headaches and costly penalties.

TIMECLICK TIP

Use your time tracking software to manage PTO and unpaid leave alongside state-paid leave benefits. It prevents payroll headaches and makes audits much easier.

Understanding Federal vs. State Family Leave Laws

The federal FMLA sets a nationwide standard for family and medical leave, but many states have gone a step further by creating their own paid leave programs. These state laws often apply to smaller companies, cover a wider range of family members, and provide partial wage replacement for employees out on leave.

As of 2025, the following states and Washington, D.C. have passed paid family leave laws. Most are already paying benefits, while Delaware and Maine begin employer contributions in 2025 with benefits scheduled to start in 2026.

| Program | Employer Coverage | Employee Eligibility | Leave Duration | Paid? |

|---|---|---|---|---|

| Federal FMLA | 50+ employees within 75 miles | 12 months tenure + 1,250 hours | 12 weeks (26 for military caregiver) | No |

| California (CFRA + PFL) | CFRA: 5+ employees; PFL: all private employees | 12 months + 1,250 hours (CFRA); $300+ earnings (PFL) | 12 weeks (CFRA); 8 weeks paid (PFL) | Yes (70–90% wage replacement) |

| Colorado | All private employers | $2,500 earnings in prior 4 quarters | 12 weeks (+4 for pregnancy complications) | Yes (~90% wage replacement, capped) |

| Connecticut | All private employers | $2,325 earnings in highest recent quarter | 12 weeks (+2 for pregnancy complications) | Yes (~95% wage replacement up to cap) |

| Delaware* | All private employers ≥10 employees (contributions in 2025) | Final regulations pending | 12 weeks (benefits start 2026) | Yes (starting 2026) |

| Maine* | All private employers ≥15 employees (contributions in 2025) | Final regulations pending | 12 weeks (benefits start 2026) | Yes (starting 2026) |

| Massachusetts | All private employers | $6,000 earnings over past 4 quarters | 12 weeks family; 20 weeks personal; max 26 total | Yes (~80% wage replacement, capped) |

| New Jersey | FLA: 30+ employees; FLI: all private employees | 12 months + 1,000 hours (FLA); past earnings (FLI) | 12 weeks family leave (+26 weeks disability for own health) | Yes (85% wage replacement, capped) |

| New York | All private employers | 26 weeks full-time or 175 days part-time | 12 weeks | Yes (67% wage replacement, capped) |

| Oregon | All private employers | $1,000 earnings in prior year | 12 weeks (+2 for pregnancy related leave) | Yes (~100% for lowest earners; sliding scale for others) |

| Rhode Island | All private employers | $15,600 in base period wages or 400+ hours | 5 weeks family leave (+30 weeks disability for own health) | Yes (~60% wage replacement, capped) |

| Washington | All employers; <50 exempt from employer premium | 820 hours worked in prior year | 12 weeks family; 12 weeks medical; up to 18 with complications | Yes (~90% wage replacement, capped) |

| Washington, D.C. | All private employers | No tenure requirement | 12 weeks parental; 12 weeks family; 12 weeks medical; 2 weeks pre-natal (stackable) | Yes (~90% wage replacement, capped) |

A quick reminder: FMLA and state leave often run at the same time. Many state programs also expand the definition of family to include siblings, grandparents, or domestic partners, and tend to cover smaller employers than federal law requires.

TIMECLICK TIP

If you have employees in more than one state, build a simple checklist of local leave requirements. It will help you stay compliant and reduce stress for both your HR team and your employees.

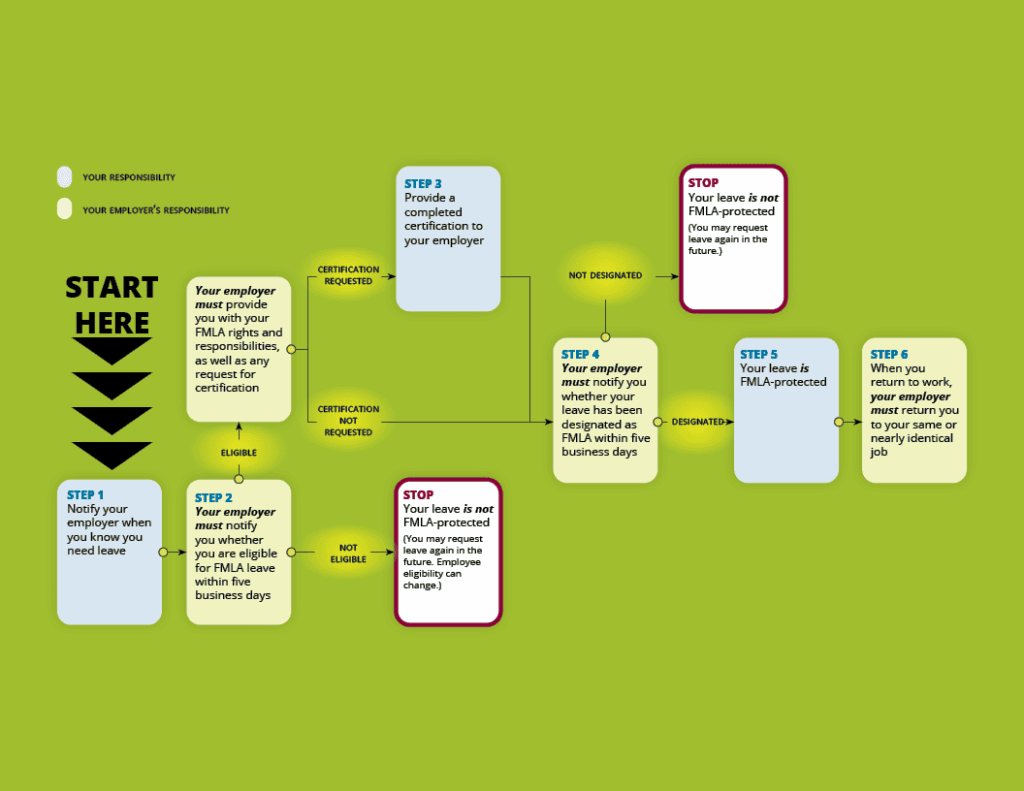

How to Apply for FMLA Leave (Employer + Employee Steps)

Applying for FMLA leave doesn’t have to be complicated, but both employees and employers must follow the process carefully to avoid delays or disputes. Here’s how it works from start to finish:

Employee Responsibilities

- Provide notice. If the need for leave is foreseeable (like a planned surgery or expected due date), the employee must give at least 30 days’ advance notice. If not, notice should be given as soon as possible.

- Submit a formal request. The employee should follow company policies and submit an FMLA request, typically to HR or their manager.

- Provide medical certification. For leave related to a serious health condition, employers may require a doctor’s note or medical certification within 15 calendar days of the request.

Employer Responsibilities

- Provide FMLA rights notice. Employers must inform employees of their FMLA rights and whether they qualify for leave.

- Designate the leave. Employers must officially notify the employee if their absence will be counted as FMLA leave. This must be done within five business days of having enough information.

- Maintain health benefits. While on leave, the employee’s group health insurance must continue under the same terms as if they were working.

- Reinstate the employee. After the leave ends, the employee must be returned to the same or an equivalent position.

Frequently Asked Questions

We’ve gathered some of the most common questions employers and employees have about FMLA. Knowing the answers can go a long way toward avoiding confusion and disputes.

When does FMLA leave begin?

FMLA leave starts on the first day an employee takes time off for a qualifying reason, once the request has been properly made and approved by the employer. Employees don’t have to use paid time off unless they and their employer agree to combine it with FMLA leave.

How does FMLA protect an employee’s job?

FMLA guarantees that an eligible employee must be returned to the same or a very similar position with equivalent pay, benefits, and work conditions after their leave ends.

Is FMLA paid leave?

Federal FMLA is unpaid. However, employees may receive income through accrued PTO, company leave policies, or state-paid family and medical leave programs where available. As of 2025, states like California, New York, New Jersey, Washington, Massachusetts, Connecticut, Oregon, Colorado, and Washington D.C. offer paid programs.

Does FMLA apply in every state?

Yes. The federal FMLA applies to eligible employees and covered employers in all 50 states. Some states also have their own family and medical leave laws that provide additional benefits or paid leave options.

What happens if an employer violates FMLA?

Employers who deny, interfere with, or retaliate against an employee for taking FMLA leave can face serious legal penalties. These may include fines, payment of back wages, job reinstatement, and covering the employee’s legal costs.

Compliance Best Practices for Employers

Staying on top of FMLA and state family leave laws can feel overwhelming, especially if you have employees in multiple states. But a proactive approach can protect your business from costly mistakes. Here’s what we recommend:

- Keep your policies up to date. Review your employee handbook and internal processes regularly to reflect current federal and state laws. State programs are expanding quickly, so aim for an annual review.

- Post the required notices. Federal law requires an FMLA poster in the workplace. Many states also require their own notices and specific information for new hires.

- Train your managers. Supervisors and HR teams should know how to handle leave requests, provide proper notices, and avoid actions that could be viewed as retaliation. Even a small misstep can create a legal issue.

- Track hours and eligibility carefully. With remote and hybrid work, accurate recordkeeping of hours worked is essential to determine FMLA eligibility.

- Coordinate federal and state leave. In most cases, federal FMLA and state paid leave run at the same time. Employees can’t be required to use PTO while getting state-paid benefits unless they choose to.

- Document everything. Always confirm leave designations and employee eligibility in writing. Clear records are your best defense if any disputes come up later.

TIMECLICK TIP

Consider using an integrated time and leave management system. It can help you stay compliant across multiple states, avoid errors, and give you back valuable time to focus on your team, not paperwork.

Conclusion

FMLA compliance has always mattered, but in 2026, it’s more complicated than ever. With federal regulations and a growing number of state paid leave laws, even the best HR teams can feel like they’re chasing moving targets.

The upside? With the right knowledge, clear policies, and reliable systems, compliance is absolutely within reach. Being proactive and organized helps protect your business and ensures your employees feel supported during life’s big transitions.

Need a better way to track hours, manage leave eligibility, and handle FMLA and paid leave documentation? TimeClick can help.

Start your FREE TimeClick Trial Today.