Overtime laws are one of the most misunderstood areas of employment compliance — and one of the most expensive to get wrong. Whether you're managing hourly workers, salaried staff, or a hybrid team, knowing when overtime kicks in (and how much it costs you) is crucial for staying compliant and protecting your bottom line.

In 2023 alone, employers paid out nearly $494 million in FLSA collective action settlements — and overtime violations were the biggest driver.

In this guide, we’ll break down exactly what counts as overtime, how it's calculated under federal law, common mistakes that lead to lawsuits, and what tools can help your business stay on the right side of the law.

Table of Contents

- What Counts as Overtime?

- Federal Overtime Laws: The FLSA

- How Is Overtime Calculated?

- Example: Hourly Employee

- Example: Including a Bonus

- Overtime for Salaried Employees

- Example: Salaried Non-Exempt Employee

- Common Mistakes Employers Make

- Penalties for Non-Compliance

- State and City Overtime Laws

- How to Stay Compliant

- Frequently Asked Questions

- Final Tips for Overtime Compliance

- Track Hours Accurately with TimeClick

What Counts as Overtime?

Under U.S. federal law, overtime refers to any hours worked over 40 in a single workweek by a non-exempt employee. When that threshold is crossed, those extra hours must be paid at a higher rate — typically time and a half (1.5x) the employee’s regular hourly rate.

A common misconception is that salaried employees are automatically exempt from overtime. That’s not true. Whether or not someone is entitled to overtime depends on how they’re classified under the Fair Labor Standards Act (FLSA).

Overtime is calculated weekly, not daily — unless you’re in a state like California, where daily thresholds also apply. We’ll get into those later in this guide.

Here’s a quick summary:

- Overtime begins after 40 hours worked in a 7-day period (federal rule)

- Paid time off and holidays do not count toward the 40-hour total

- Time worked over 40 hours must be paid at 1.5x the regular rate

- "Comp time" can’t be used in place of overtime pay (unless public sector)

Federal Overtime Laws: The FLSA

The Fair Labor Standards Act (FLSA) is the federal law that sets overtime rules for most U.S. workers. It defines who gets overtime, how it's calculated, and what counts as “work time.” If you’re an employer, this is the core law you need to understand.

Under the FLSA, only non-exempt employees are eligible for overtime pay. Exempt employees are not — but determining who qualifies as exempt isn't always straightforward.

Here’s a quick breakdown of the two classifications:

| Classification | Eligible for Overtime? | Common Examples |

|---|---|---|

| Non-Exempt | Yes | Hourly workers, retail staff, assistants, warehouse employees |

| Exempt | No | Managers, professionals, executives, salaried administrative roles |

For an employee to qualify as exempt, they typically must meet all three of the following tests:

- Salary Basis Test: They are paid a fixed salary, not hourly.

- Salary Level Test: They earn more than $684/week (or $35,568/year). A 2024 proposal would have raised this, but it was blocked by federal court action.

- Duties Test: Their job duties fit an exempt category.

Which Categories classify as exempt?

- Executive: Manages others and has authority over hiring/firing.

- Administrative: Performs office work related to business operations with discretion and judgment.

- Learned Professional: Requires advanced education in a specialized field (e.g., doctors, lawyers).

- Creative Professional: Engages in creative work (e.g., writers, designers, artists).

- Computer Employees: Includes systems analysts, programmers, and software engineers.

- Outside Sales: Regularly works outside the office and makes sales or obtains contracts.

- Highly Compensated Employees: Earns $107,432+ and performs some exempt duties.

- Academic Administrative: Applies to roles in educational institutions involved in curriculum or instruction.

A proposed 2025 rule would have increased the exemption threshold to $1,128/week ($58,656/year), but it did not take effect due to legal challenges. Some states, like California, have set their own, higher minimums for exemption.

To learn more about employee classification rules, visit the DOL’s Overtime Fact Sheet.

Simplify Time Tracking with TimeClick!

Download our free trial—simple, secure, offline tracking, no fluff.

How Is Overtime Calculated?

Overtime pay is typically calculated at 1.5 times an employee’s regular hourly rate for all hours worked beyond 40 in a single workweek. It sounds simple — but mistakes happen when bonuses, commissions, or multiple hourly rates come into play.

Here’s a basic formula for calculating overtime:

- Step 1: Find the employee’s regular hourly rate.

- Step 2: Multiply that rate by 1.5 to determine the overtime rate.

- Step 3: Multiply the overtime rate by the number of overtime hours worked.

- Step 4: Add regular earnings and overtime earnings for the total pay.

Example: Hourly Employee

An employee earns $18/hour and works 45 hours in a workweek.

Regular pay: 40 hours × $18 = $720

Overtime pay: 5 hours × ($18 × 1.5) = $135

Total pay = $855

Example: Including a Bonus

If an employee earns a production bonus during the same week, that bonus must be factored into their regular rate before calculating overtime.

For example, if they earned a $200 bonus that week:

Adjusted regular rate = (straight-time earnings + bonus) ÷ total hours worked

Recalculate the overtime based on this adjusted rate.

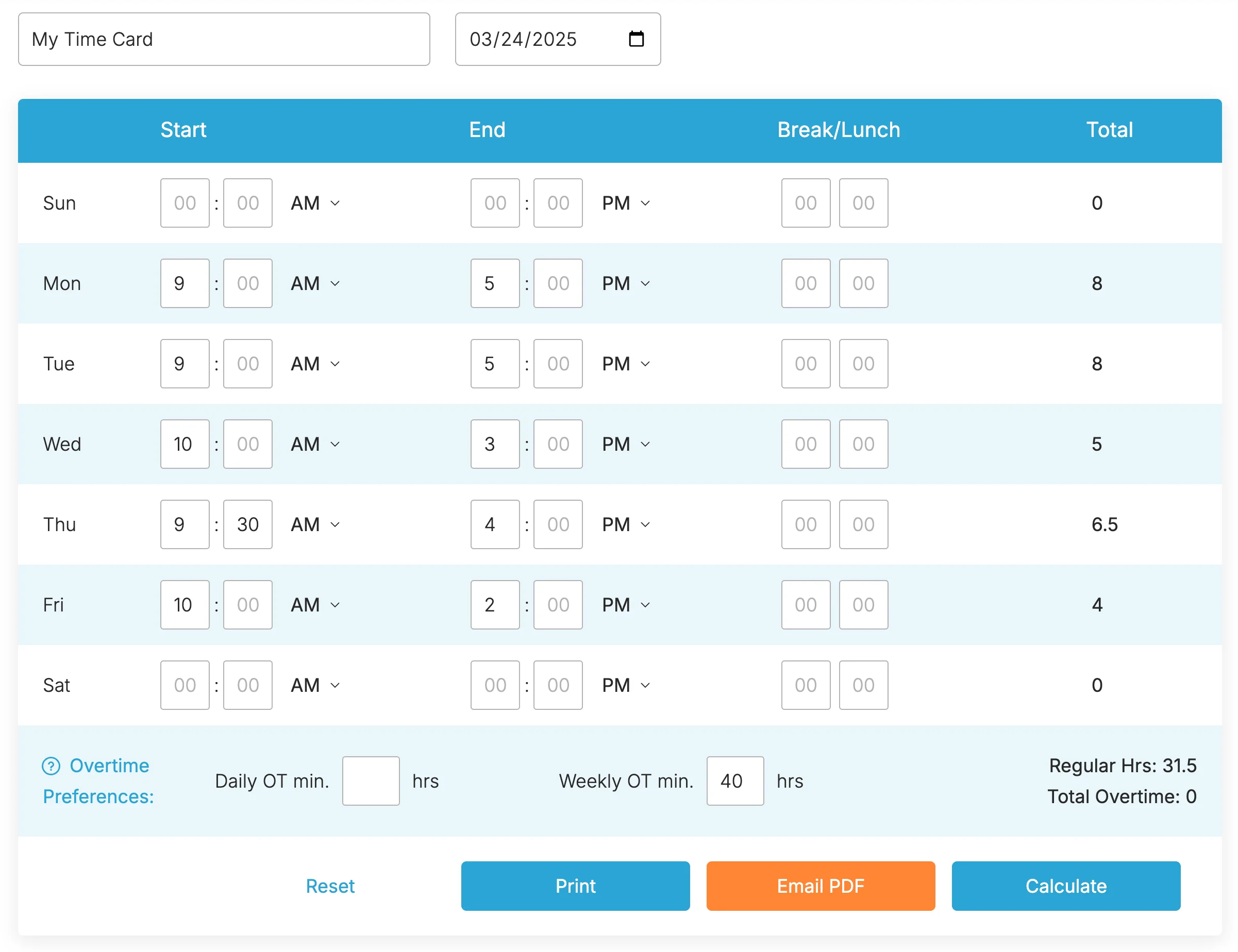

TIMECLICK TIP

Bonuses and commissions can complicate overtime math quickly. Use our free Time Card Calculator to double-check your calculations.

Overtime for Salaried Employees

Many employers mistakenly believe that if an employee is salaried, overtime rules don’t apply. That’s not true. A salaried employee can still be non-exempt and entitled to overtime pay if they don’t meet all the exemption requirements under the FLSA.

Here’s how to determine whether a salaried employee must receive overtime:

- Salary Level: Employees earning less than $684 per week ($35,568 annually) are generally non-exempt and eligible for overtime, regardless of their duties.

- Job Duties: To be exempt, employees must primarily perform executive, administrative, professional, computer, or outside sales duties.

- Salary Basis: Employees must receive a consistent salary that isn't docked based on quantity or quality of work (with limited exceptions).

If any of these tests are not met, the employee must be classified as non-exempt and paid overtime for hours worked over 40 in a week.

Example: Salaried Non-Exempt Employee

A salaried employee earns $600 per week and works 50 hours. Because their salary is below the $684/week threshold, they are non-exempt and entitled to overtime.

Regular hourly rate = $600 ÷ 40 = $15/hour

Overtime rate = $15 × 1.5 = $22.50/hour

Overtime pay = 10 hours × $22.50 = $225

Total pay = $600 + $225 = $825

Always verify both the salary level and job duties before assuming that a salaried worker is exempt from overtime laws.

For more guidance, review the Department of Labor’s Overtime Rules for Salaried Employees Fact Sheet.

Common Mistakes Employers Make

Even well-meaning businesses can get tripped up by overtime laws. Here are some of the most common (and costly) mistakes employers make:

- Misclassifying employees: Incorrectly labeling someone as exempt when they don’t meet the salary or duties test can lead to major back pay penalties.

- Averaging hours across weeks: Overtime is calculated week-by-week — you can’t average two weeks together to avoid paying it.

- Excluding bonuses or commissions: Non-discretionary bonuses must be included in the regular rate when calculating overtime pay.

- Failing to track all work time: Employees must be paid for all hours worked — including off-the-clock tasks like emails or remote work.

- Offering comp time illegally: Private-sector employers generally cannot substitute future time off for overtime pay.

Small errors add up quickly, especially when multiple employees are involved. A few overlooked hours here and there can spiral into six- or seven-figure liability in a lawsuit.

TIMECLICK TIP

Automate overtime tracking with TimeClick to prevent miscalculations. Built-in alerts notify managers when employees approach overtime limits, helping you stay compliant effortlessly.

CASE STUDY

A major retailer paid $65 million to settle an overtime misclassification lawsuit involving assistant managers. Even unintentional errors can lead to massive exposure when hundreds of employees are affected.

Penalties for Non-Compliance

Ignoring overtime laws doesn’t just lead to unhappy employees — it can lead to serious financial and legal consequences for your business. The Department of Labor (DOL) and private lawsuits aggressively enforce overtime violations.

Here’s what’s at stake if you don’t comply:

- Back Wages: You may be required to pay up to two years’ worth of unpaid overtime — or three years if the violation was willful.

- Liquidated Damages: Courts often award double damages, meaning you could pay twice the amount owed.

- Fines and Civil Penalties: Willful violations can trigger civil penalties of up to $1,000 per violation — and even criminal charges for repeat offenders.

- Class-Action Lawsuits: A single employee’s complaint can escalate into a massive collective action involving hundreds or thousands of past employees.

- Reputation Damage: Wage lawsuits are public record and can severely hurt your brand’s credibility with customers, employees, and investors.

In 2024, the DOL recovered over $149.9 million in back wages for workers — with overtime violations accounting for approximately $126.9 million. Private lawsuits were even more costly, with average FLSA settlements topping $1.17 million per case.

Compliance isn't just cheaper — it’s essential to protecting your workforce, reputation, and financial future. To understand what’s at stake, see the full list of DOL enforcement penalties.

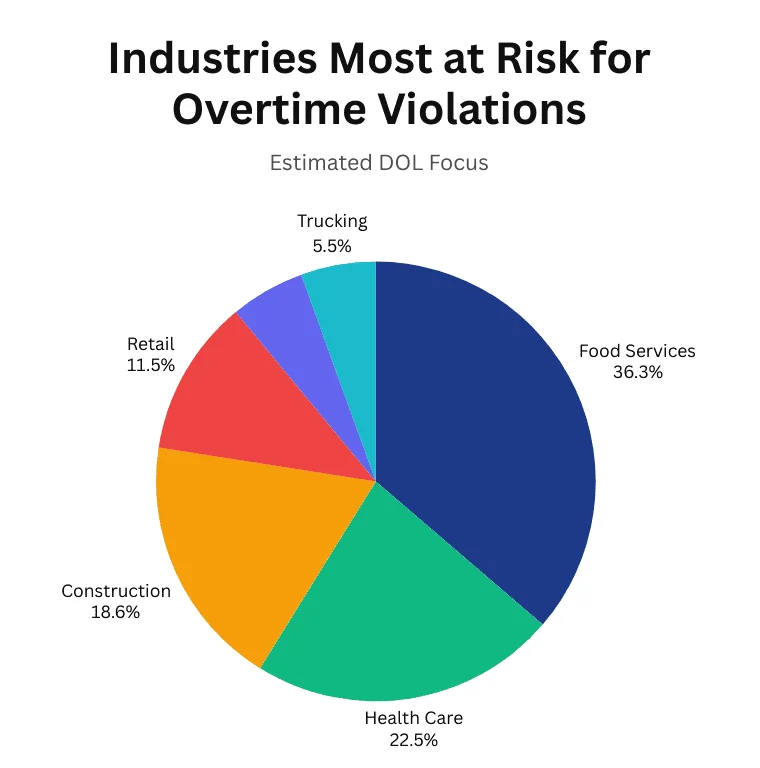

But staying compliant isn't always easy — especially in industries where long hours, low wages, and high turnover are common. In fact, Department of Labor data shows that certain sectors consistently lead in overtime violations and back wages owed. Let's take a closer look at the industries most at risk.

Top Takeaways:

- Most Investigated: Food Services, Health Care, and Construction had the highest number of federal actions and recovered wages in 2024.

- Common Issues: These include misclassifying workers as independent contractors, not paying for overtime hours, or not keeping proper time records.

- High Violation Rates: In some personal service industries (like security and janitorial work), studies found that up to 70–90% of investigations revealed some type of violation.

- Real-World Impact: Working overtime without pay isn’t just unfair — it increases injury risk, financial stress, and legal exposure for businesses.

Here’s a summary of 2024 labor investigations and back wages by industry:

| Industry | Investigations (2024) | Back Wages Recovered | Common Violation Patterns |

|---|---|---|---|

| Food Services | 3,827 | $35.1 million | High turnover and seasonal work; unpaid off-the-clock hours common. |

| Health Care | 2,376 | $37.8 million | Nursing homes especially affected; long shifts, misclassified roles. |

| Construction | 1,966 | $32.1 million | Misclassified workers as contractors; inconsistent work hours. |

| Retail | 1,217 | $6.3 million | Fluctuating shifts; common wage theft and unpaid overtime. |

| Guard Services | 577 | $3.7 million | Often subcontracted; studies show 70–90% of audits find violations. |

| Trucking | 582 | $1.1 million | Drivers misclassified as contractors; unpaid long-haul hours. |

While not every employer in these industries is out of compliance, these numbers show where violations are most commonly found during investigations. Employees should track hours carefully, and businesses should review their payroll practices to stay compliant.

State and City Overtime Laws

While the FLSA sets a national baseline—time-and-a-half for hours worked over 40 in a workweek—many states and cities go further with stricter rules. These may include daily overtime thresholds, double time pay, seventh-day premiums, or industry-specific protections.

If your business operates in one of these jurisdictions, you must follow the rule that provides the greatest benefit to the employee—whether it’s federal, state, or local law.

| Jurisdiction | Daily OT | Weekly OT | Double Time | Special Rules |

|---|---|---|---|---|

| California | After 8 hrs | After 40 hrs | After 12 hrs/day or >8 hrs on 7th day | 7th day premiums, domestic and farmworker OT included |

| Colorado | After 12 hrs or 12 consecutive hrs | After 40 hrs | No | Farmworkers receive OT after 48 hrs (2025); long shift bonus >15 hrs |

| Alaska | After 8 hrs | After 40 hrs | No | Small employers and certain job types exempt |

| Nevada | After 8 hrs (if earning <1.5× min wage) | After 40 hrs | No | Threshold applies only to lower-paid workers |

| Oregon | After 10 hrs (specific industries) | After 40 hrs | No | Applies to manufacturing/packing plants; ag workers OT after 48 hrs (2025) |

| New York | None | After 40 hrs | No | Live-in domestic OT after 44 hrs; “spread of hours” and rest day premiums |

| Rhode Island | None | After 40 hrs | No | 1.5× pay required on Sundays and most holidays |

| Connecticut | None | After 40 hrs | No | Restaurant/hotel workers: 7th day must be paid at 1.5× minimum wage |

| Kentucky | None | After 40 hrs | No | Work on 7th consecutive day = 1.5× pay (even under 40 hrs) |

| North Carolina | None | After 40 hrs | No | Amusement/recreation employers must pay OT after 45 hrs/week |

| Washington | None | After 40 hrs | No | Farmworkers fully covered as of 2024 (OT after 40 hrs) |

| Los Angeles, CA (City) | Consent required after 10 hrs (hotel workers) | Follows CA | Yes – for exceeding daily room quota | Hotel workers: excessive workload triggers 2× pay for full day |

| Seattle, WA (City) | None | Follows WA | Yes – “Triple time” for exceeding 4,500 sq ft/day (hotel workers) | Consent required for OT shifts; workload-based premium rules |

These jurisdictions require overtime pay beyond federal law. If your business operates across state lines—or in cities with local ordinances—be sure your policies apply the most employee-friendly rule available.

How to Stay Compliant

Staying compliant with overtime laws isn’t just about knowing the rules — it’s about building reliable systems that prevent mistakes before they happen. Here’s how to protect your business and your employees:

- Track all hours worked: Require employees to record all work time, including remote work, emails, and calls outside normal hours.

- Audit employee classifications: Regularly review exempt and non-exempt status to match current salary thresholds and job duties.

- Monitor overtime thresholds: Use time tracking software that alerts you when employees approach 40 hours in a workweek.

- Train managers and supervisors: Ensure your leadership team understands overtime laws and proper scheduling practices.

- Stay updated on legal changes: Overtime regulations can shift at both federal and state levels — monitor updates from the Department of Labor and local agencies.

TIMECLICK TIP

TimeClick’s time tracking system helps you automatically flag potential overtime issues, set alerts, and maintain clean, audit-ready records. Try our free Time Card Calculator to see how quickly overtime costs can add up.

Building a proactive compliance system not only reduces legal risk — it also fosters a workplace culture of fairness, transparency, and trust.

Frequently Asked Questions

Overtime compliance can raise a lot of questions — especially when it comes to salaried workers, bonuses, and different workweek structures. Here are answers to some of the most common overtime questions employers ask.

Do I have to pay overtime to salaried employees?

Not necessarily. Salaried employees are only exempt from overtime if they meet both the salary threshold and specific job duties tests under the FLSA. Otherwise, they are considered non-exempt and must be paid overtime for hours over 40 in a workweek.

What’s the difference between exempt and non-exempt employees?

Non-exempt employees are entitled to overtime pay under federal law. Exempt employees are not — but only if they meet strict criteria based on salary level, salary basis, and job duties.

Does paid time off (PTO) count toward overtime?

No. Only actual hours worked count toward the 40-hour threshold for overtime. PTO, sick leave, holidays, and vacation time are excluded when calculating overtime eligibility.

Can I offer comp time instead of overtime pay?

If you’re a private-sector employer, generally no. Under the FLSA, private employers must pay overtime wages — not offer compensatory time off — unless very limited exceptions apply.

How often should I review employee classifications?

At least once a year — or anytime an employee's job duties or compensation structure changes. Regular audits help avoid costly misclassification errors.

Final Tips for Overtime Compliance

Overtime compliance isn’t just about avoiding fines — it’s about building a workplace where employees are treated fairly, schedules are predictable, and trust is built through transparency.

With overtime lawsuits costing U.S. employers nearly half a billion dollars a year, proactive compliance is no longer optional. Regularly audit your employee classifications, track every hour worked, and monitor for approaching overtime thresholds.

Small steps now can save you from major penalties, public lawsuits, and brand damage later.

Track Hours Accurately with TimeClick

TimeClick helps you stay on top of overtime compliance effortlessly. Our easy-to-use time tracking system automatically flags overtime risks, keeps accurate audit trails, and protects your business from costly errors.

Ensure compliance, minimize risk, and treat your team right. Start your FREE 14-day TimeClick trial today — and take the stress out of overtime tracking.

Start your FREE TimeClick Trial Today.